UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Period Ended January 3, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report __________

Commission file number 001-39251

BETTERWARE DE MÉXICO, S.A.B. DE C.V.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

MEXICO

(Jurisdiction of incorporation or organization)

Luis Campos, Board Chairman

+52 (33) 3836-0500

Luis Enrique Williams 549

Colonia Belenes Norte

Zapopan, Jalisco, 45145, México

(Name, Telephone, E-mail and or Facsimile number and Address Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange in which registered | ||

| Ordinary Shares, no par value per share | BWMX | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 36,584,968 Ordinary Shares, as of January 3, 2021.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☐ Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International

Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

TABLE OF CONTENTS

i

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains a number of forward-looking statements, including statements about the financial conditions, results of operations, earnings outlook and prospects and may include statements for the period following the date of this annual report. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of Betterware, as applicable, and are inherently subject to uncertainties and changes in circumstance and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Given these uncertainties, you should not rely upon forward looking statements as predictions of future events. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the Securities and Exchange Commission (“SEC”) by Betterware and the following:

| ● | geopolitical risk and changes in applicable laws or regulations; |

| ● | the inability to profitably expand into new markets; |

| ● | the possibility that Betterware may be adversely affected by other economic, business and/ or competitive factors; |

| ● | financial performance; |

| ● | operational risk; |

| ● | litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on Betterware’s resources; |

| ● | changes in our investment commitments or our ability to meet our obligations thereunder; |

| ● | natural disaster-related losses which may not be fully insurable; |

| ● | epidemics, pandemics and other public health crises, particularly the COVID-19 virus; |

| ● | fluctuations in exchange rates between the Mexican peso and the United States dollar; and |

| ● | changes in interest rates or foreign exchange rates. |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of Betterware prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Except to the extent required by applicable law or regulation, Betterware undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

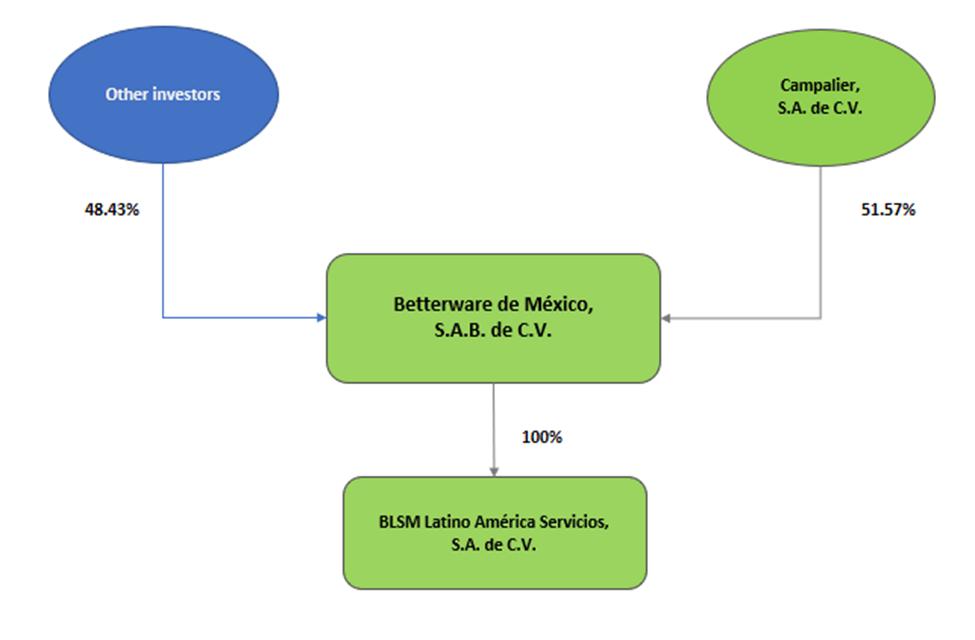

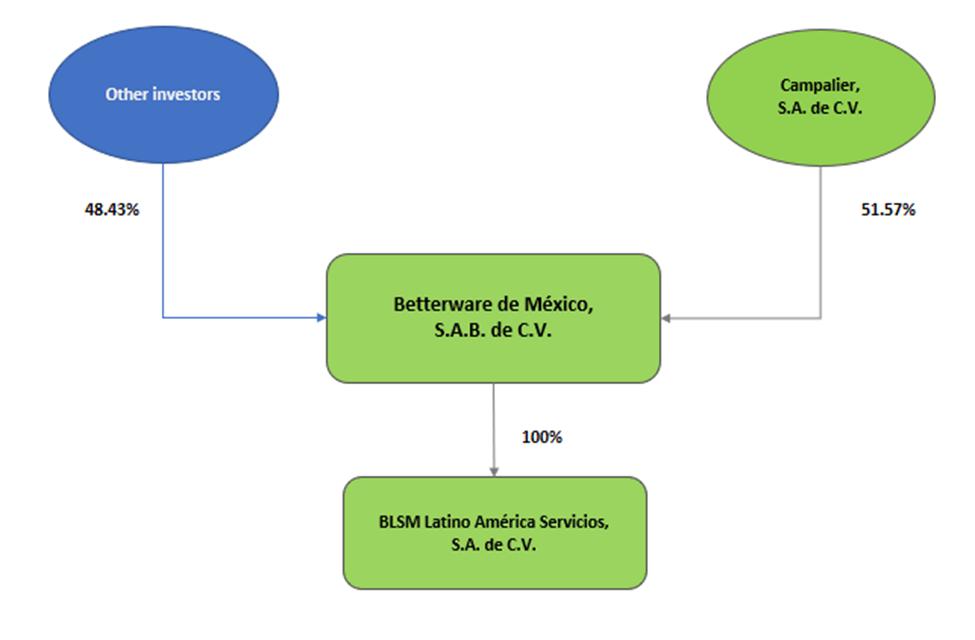

Betterware de México, S.A.B. de C.V. (formerly Betterware de México, S.A.P.I. de C.V.) was incorporated under the laws of Mexico in 1995. Unless otherwise stated or unless the context otherwise requires, the terms “we,” “us,” “our,” “Company,” the “Group” “Betterware,” “BTW,” “BWM” and “BW” refer to Betterware de México, S.A.B. de C.V. and BLSM Latino América Servicios, S.A. de C.V., a Mexican sociedad anónima de capital variable.

iii

In this annual report, unless otherwise specified or the context otherwise requires:

| ● | “$,” “US$” and “U.S. dollar” each refer to the United States dollar; and |

| ● | “MX$,” “Ps.” and “peso” each refer to the Mexican peso. |

Certain numbers and percentages included in this annual report have been subject to rounding adjustments. Accordingly, figures shown for the same category presented in various tables or other sections of this annual report may vary slightly, and figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them.

PRESENTATION OF FINANCIAL INFORMATION

This annual report contains our Audited Consolidated and Combined Financial Statements as of January 3, 2021 and December 31, 2019 and for the 53 weeks ended January 3, 2021 (referred to as the “2020 period”), the 52 weeks ended December 31, 2019 (referred to as the “2019 period”) and the 52 weeks ended December 31, 2018 (referred to as the “2018 period”) (our “Audited Consolidated and Combined Financial Statements”).

Our financial year consists of a 52- or 53-week period ending on the Sunday nearest to, either before or after, December 31. For purposes of this annual report, the term fiscal year is synonymous with financial year and refers to the periods covered by our Audited Consolidated and Combined Financial Statements.

We prepare our Audited Consolidated and Combined Financial Statements in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). We have applied all IFRS issued by the IASB effective at the time of preparing our Audited Consolidated and Combined Financial Statements. Our Audited Consolidated and Combined Financial Statements as of January 3, 2021 and December 31, 2019, and for the 2020 period and the 2019 period, have been audited by Galaz, Yamazaki, Ruiz Urquiza, S.C. member of Deloitte Touche Tohmatsu Limited (“Deloitte”), an independent registered public accounting firm, whose report dated March 25, 2021, is also included in this annual report. Our Audited Combined Financial Statements for the 2018 period, were audited by KPMG Cárdenas Dosal, S.C. a member firm of KPMG International Coperative (“KPMG”), an independent registered public accounting firm, whose report dated September 27, 2019, is also included in this annual report.

Prior to BLSM Latino América Servicios, S.A. de C.V., a Mexican sociedad anónima de capital variable (“BLSM”), becoming a subsidiary of Betterware, we prepared combined financial statements because it provided more meaningful information to the reader as Betterware and BLSM were subsidiaries under the common control of Campalier, operating under common management; Considering the foregoing, combined financial statements of these entities were prepared as of December 31, 2019 and 2018. On March 10, 2020, BLSM became a subsidiary of Betterware and thus included in our consolidated financial statements as of such date. As a result, the combined statement of changes in stockholders’ equity for the 2019 and 2018 periods present the net parent investment gross by including contributed capital and retained earnings (rather than net as presented in prior years), as management believes it is a preferable presentation for comparability purposes with the share structure and presentation for the 2020 period. Our Audited Consolidated and Combined Financial Statements are presented in thousands of Mexican Pesos (Ps).

Non-IFRS Measures

We define “EBITDA” as profit for the year adding back the depreciation of property, plant and equipment and right of use assets, amortization of intangible assets, financing cost, net and total income taxes. Adjusted EBITDA also excludes the effects of gains or losses on sale of fixed assets and adds back other non-recurring expenses. EBITDA and Adjusted EBITDA are not measures required by or presented in accordance with IFRS. The use of EBITDA and Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for analysis of, our results of operations or financial condition as reported under IFRS.

Betterware believes that these non-IFRS financial measures are useful to investors because (i) Betterware uses these measures to analyze its financial results internally and believes they represent a measure of operating profitability and (ii) these measures will serve investors to understand and evaluate Betterware’s EBITDA and provide more tools for their analysis as it makes Betterware’s results comparable to industry peers that also prepare these measures.

iv

The Business Combination

The Initial Public Offering

On October 16, 2018, DD3 Acquisition Corp., a British Virgin Islands company (“DD3”), consummated its initial public offering of 5,000,000 units and on October 23, 2018, the underwriters for DD3’s initial public offering purchased an additional 565,000 units pursuant to the partial exercise of their over-allotment option. The units in DD3’s initial public offering were sold at an offering price of U.S.$10.00 per unit, generating total gross proceeds of U.S.$55,650,000.

The Merger

On August 2, 2019, DD3 entered into a Combination and Stock Purchase Agreement (as amended, the “Combination and Stock Purchase Agreement”) with Campalier, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Campalier”), Promotora Forteza, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Forteza”), Strevo, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Strevo”, and together with Campalier and Forteza, “Sellers”), Betterware, BLSM, and, solely for the purposes of Article XI therein, DD3 Mex Acquisition Corp, S.A. de C.V., pursuant to which DD3 agreed to merge with and into Betterware (the “Merger”) in a Business Combination that resulted in Betterware surviving the Merger and BLSM becoming a wholly-owned subsidiary of Betterware.

As part of the Combination and Stock Purchase Agreement, and prior to the closing of the Merger, DD3 was redomiciled out of the British Virgin Islands and continued as a Mexican corporation pursuant to Section 184 of the Companies Act and Article 2 of the Mexican General Corporations Law.

The Company Restructure

Following the execution of the Combination and Stock Purchase Agreement, on February 21, 2020, the Company’s shareholders approved, a corporate restructure in the Company (the “Company Restructure”) which implied, among other things (i) the Company’s by-laws amendment in order to issue Series C and Series D non-voting shares, and (ii) a redistribution of the Company’s capital stock as follows: (a) fixed portion of the Company’s capital stock represented by 3,075,946, Series A, ordinary voting shares, and (b) the variable portion of the Company’s capital stock represented by (x) 1,961,993, Series B, ordinary voting shares, (y) 897,261, Series C, ordinary non-voting shares (“Series C Shares”), and (z) 168,734, Series D, ordinary non-voting shares (“Series D Shares”). In addition, Strevo transferred one, Series A, ordinary voting share of Betterware to Campalier (the “Campalier Share”), which remained under certain Share Pledge Agreement, dated July 28, 2017, entered between Strevo, as pledgor, MCRF P, S.A. de C.V. SOFOM, E.N.R. (“CS”), as pledgee, and Betterware.

Immediately after the Company’s Restructure and the transfer of the Campalier Share to Campalier, Forteza indirectly owned, through Banco Invex, S.A., Invex Grupo Financiero (“Invex”), as trustee of the irrevocable management and security trust No. 2397 (the “Invex Security Trust”), executed on March 26, 2016, as amended, with CS, as beneficiary, approximately 38.94% of the outstanding common stock of Betterware, and Campalier indirectly owned, through the Invex Security Trust, approximately 61.06% of the outstanding common stock of Betterware.

On March 9, 2020, the Invex Security Trust released the Series C Shares and the Series D Shares to Campalier and Forteza, respectively, that were held under the Invex Security Trust.

On March 10, 2020, CS, as pledgee, entered into a Termination of the Share Pledge Agreement over the Campalier Share with Campalier, as pledgor, and Betterware. In addition, CS, as beneficiary, Invex, as trustee, and Campalier, as settlor, entered into a Transfer Agreement, where Campalier transferred the Campalier Share to the Invex Security Trust.

Upon such transfer to the Invex Security Trust, the Company’s shareholders approved (i) the sale of all or a portion of such Company’s Series C and Series D shares to DD3 Acquisition Corp., S.A. de C.V. (the “DD3 Acquisition”), (ii) the Merger, (iii) the amendment of the Company’s by-laws to become a sociedad anónima promotora de inversion de capital variable, (iv) the increase of the Company’s capital stock by MX$94,311,438.00, through the issuance of 2,211,075 ordinary shares, without nominal value, subscribed by the shareholders of DD3 Acquisition Corp., S.A. de C.V., and (v) the increase of the Company’s capital stock by MX$872,878,500.00 through the issuance of 4,500,000 ordinary treasury shares without nominal value, offered for subscription and payment under the Company’s public offering in the U.S. completed and filed with the SEC under our Registration Statement on Form F-1, which became effective on January 22, 2020.

v

On March 10, 2020, Betterware’s corporate name changed from Betterware de México, S.A. de C.V. to Betterware de México, S.A.P.I. de C.V.

The DD3 Acquisition was closed on March 13, 2020, and as a result, all of Betterware shares that were issued and outstanding immediately prior to the closing date were canceled and new shares were issued. The DD3 Acquisition was accounted as a capital reorganization, whereby Betterware issued shares to the DD3 shareholders and obtained US$22,767 (Ps.498,445) in cash through the acquisition of DD3 and, simultaneously settled liabilities and related transaction costs on that date, for net cash earnings of US$7,519 (Ps.181,734) on such date. In addition, Betterware assumed the obligation of the warrants issued by DD3, a liability inherent to the transaction, equivalent to the fair value of Ps.55,810 of the warrants. No other assets or liabilities were transferred as part of the transaction that required adjustment to fair value as a result of the acquisition.

On the same date, a total of 2,040,000 of Betterware shares, that were offered for subscription and payment under its public offering on Nasdaq Capital Market (“Nasdaq”), were subscribed and paid for by various investors.

On July 14, 2020, Betterware’s corporate name changed from Betterware de México, S.A.P.I. de C.V. to Betterware de México, S.A.B. de C.V. For purposes of this annual report, the Merger, the Company Restructure and all related actions undertaken in connection thereto are referred to as the “Business Combination.”

The Business Combination

Upon satisfaction of certain conditions and covenants as set forth under the Combination and Stock Purchase Agreement, the Business Combination was consummated and closed on March 13, 2020 (the “Closing”). At Closing, the following actions occurred:

| (i) | DD3 issued to the Sellers as consideration for the purchase of a portion of the Series C and Series D shares and the BLSM shares outstanding as of December 31, 2019, a debt acknowledgement in an amount equal to $15,000,546.00; |

| (ii) | all of Betterware shares issued and outstanding immediately prior to the Closing were canceled and, Campalier and Forteza received, directly and indirectly (through the Invex Security Trust), 18,438,770 and 11,761,175, respectively, of Betterware’s shares; and |

| (iii) | all of DD3’s ordinary shares issued and outstanding immediately prior to the Closing were canceled and exchanged for Betterware shares on a one-for-one basis. |

Immediately after the Closing, on the same day, 2,040,000 shares of the Company offered for subscription and payment under the Company’s public offering in the U.S. on the Nasdaq were subscribed and paid for by various investors.

As a result of the Business Combination and the additional shares issued in the public offering, Betterware had 34,451,020 issued and outstanding shares, distributed as follows:

| (i) | 25,669,956 shares, representing 74.5% of the total capital stock, are held by Invex Security Trust, as trustee and for the benefit of CS, as first place beneficiary thereunder; |

| (ii) | 1,764,175 shares, representing 5.1% of the total capital stock, are owned by Forteza; |

| (iii) | 2,765,814 shares, representing 8.0% of the total capital stock, are owned by Campalier; |

| (iv) | 2,211,075 shares, representing 6.4% of the total capital stock, are owned by former DD3 Shareholders as a result of the cancellation of DD3’s ordinary shares and exchange for Betterware shares on a one-for-one basis; and |

| (v) | 2,040,000 shares, representing 5.9% of the total capital stock, are owned by the F-1 Investors. |

vi

As part of the Merger, Betterware assumed an obligation that granted existing warrant holders the option to purchase (i) a total of 5,804,125 Betterware shares at a price of US$11.50 per share that would expire on or before March 25, 2025, and (ii) a total of 250,000 units that automatically became an option to issue 250,000 Betterware shares and warrants to buy 250,000 additional Betterware shares. The Company registered the warrants to be traded on OTC Markets, which had an observable fair value. The following events occurred in 2020 as part of the warrants agreement:

| (i) | During July and August 2020, the Group repurchased 1,573,888 warrants. During August and October, 2020, 895,597 warrants were exchanged for 621,098 shares, of which, 462,130 warrants were settled on a cash basis by exchanging 1 warrant for 1 share at a price of US$11.44 for share, which resulted in receiving cash by an amount of Ps.116,419. The remaining 433,467 warrants were exchanged on a cashless basis by exchanging 1 warrant for 0.37 shares. |

| (ii) | in September 2020, the purchase option of units was exercised by their holders on a cashless basis, which resulted in the issuance of 214,020 Betterware shares. |

| (iii) | Additionally, in October, 2020, and as part of the terms of the warrant agreement, the Company exercised the redemption of the warrants on a cashless basis by exchanging 3,087,022 warrants for 1,142,325 of the Company’s shares. A total of 8,493 public warrants were not exercised by their holders during the redemption period that expired on November 9, 2020, therefore, they were paid by the Company for a price of US$0.01 per warrant. |

| (iv) | In December, 2020, holders exercised a total of 239,125 private warrants on a cashless basis and exchanged for 156,505 of the Company’s shares. |

| (v) | As of the date of this annual report, the warrant holders had redeemed all of the outstanding warrants and purchase option of units and the Company recognized a loss for the increase in the fair value of the warrants of Ps.851,520, which is recognized under the heading “Loss in valuation of warrants” in the consolidated and combined statement of profit or loss. |

As of the date of this annual report and as consequence of the transactions described before, the total number of outstanding shares of the Company is 36,584,968.

PRESENTATION OF INDUSTRY AND MARKET DATA

In this annual report, we rely on, and refer to, information regarding our business and the markets in which we operate and compete. The market data and certain economic and industry data and forecasts used in this annual report were obtained from internal surveys, market research, governmental and other publicly available information and independent industry publications. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We believe that these industry publications, surveys and forecasts are reliable, but we have not independently verified them and cannot guarantee their accuracy or completeness.

Certain market share information and other statements presented herein regarding our position relative to our competitors are not based on published statistical data or information obtained from independent third parties, but reflects our best estimates. We have based these estimates upon information obtained from publicly available information from our competitors in the industry in which we operate.

vii

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | SELECTED FINANCIAL DATA |

The following selected consolidated and combined financial information and other data of the Company should be read in conjunction with, and are qualified by reference to, “Item 5. Operating and Financial Review and Prospects” and our Audited Consolidated and Combined Financial Statements and the notes thereto included elsewhere in this annual report. Our financial information is presented in thousands of Mexican pesos unless otherwise instructed.

The selected consolidated and combined statement of financial position data and the selected consolidated and combined statement of income, comprehensive income and cash flow data for the 2020, 2019 and 2018 periods, respectively have been derived from our Audited Consolidated and Combined Financial Statements included elsewhere in this annual report.

We prepare our Audited Consolidated and Combined Financial Statements in accordance with IFRS as issued by the IASB. We have applied all IFRS issued by the IASB effective at the time of preparing our Audited Consolidated and Combined Financial Statements.

Selected

Statement of Financial Position Data as of January 3, 2021, December 31, 2019 and 2018

(In thousands of Mexican pesos “Ps.”)

| As of January 3, 2021 | As of December 31, 2019 | As of December 31, 2018 | ||||||||||

| Assets | ||||||||||||

| Current assets: | ||||||||||||

| Cash and cash equivalents | Ps. | 649,820 | 213,697 | 177,383 | ||||||||

| Trade accounts receivable, net | 757,806 | 247,087 | 198,776 | |||||||||

| Inventories | 1,274,026 | 345,554 | 302,206 | |||||||||

| Other current assets(1) | 224,918 | 74,368 | 51,485 | |||||||||

| Total current assets | 2,906,570 | 880,706 | 729,851 | |||||||||

| Property, plant and equipment, net | 791,127 | 207,350 | 42,972 | |||||||||

| Intangible assets, net | 319,361 | 310,965 | 312,099 | |||||||||

| Goodwill | 348,441 | 348,441 | 348,441 | |||||||||

| Other non-current assets(2) | 48,261 | 42,264 | 24,235 | |||||||||

| Total non-current assets | 1,507,190 | 909,020 | 727,748 | |||||||||

| Ps. | 4,413,760 | 1,789,726 | 1,457,598 | |||||||||

| (1) | Includes also prepaid expenses. |

| (2) | Includes also right of use assets, net, and deferred income tax. |

1

Selected

Statement of Financial Position Data as of January 3, 2021, December 31, 2019 and 2018

(In thousands of Mexican pesos “Ps.”)

| As of January 3, 2021 | As of December 31, 2019 | As of December 31, 2018 | ||||||||||

| Liabilities and Stockholders’ equity | ||||||||||||

| Current Liabilities: | ||||||||||||

| Borrowings | Ps. | 105,910 | 148,070 | 90,691 | ||||||||

| Accounts payable to suppliers | 2,078,628 | 529,348 | 445,241 | |||||||||

| Other current liabilities(1) | 682,859 | 200,940 | 198,512 | |||||||||

| Total current liabilities | 2,867,397 | 878,358 | 734,444 | |||||||||

| Non-current Liabilities: | ||||||||||||

| Deferred Income tax | 56,959 | 78,501 | 70,627 | |||||||||

| Borrowings | 523,967 | 529,643 | 562,788 | |||||||||

| Other non-current liabilities(2) | 43,544 | 28,742 | 9,475 | |||||||||

| Total non-current liabilities | 624,470 | 636,886 | 642,890 | |||||||||

| Total liabilities | 3,491,867 | 1,515,244 | 1,377,334 | |||||||||

| Stockholders’ equity | 921,893 | 274,482 | 80,264 | |||||||||

| Ps. | 4,413,760 | 1,789,726 | 1,457,598 | |||||||||

| (1) | Includes accrued expenses, provisions, income tax and value added tax payable, employee profit sharing payable, lease liability and derivative financial instruments. |

| (2) | Includes statutory employee benefits, derivative financial instruments and lease liability. |

Selected

Statement of Profit or Loss Data for the 2020 period, the 2019 period and the 2018 period

(In thousands of Mexican pesos “Ps.”)

| January 3, 2021 | December 31, 2019 | December 31, 2018 | ||||||||||

| Net revenue | Ps. | 7,260,408 | 3,084,662 | 2,316,716 | ||||||||

| Cost of sales | 3,290,994 | 1,280,829 | 958,469 | |||||||||

| Gross profit | 3,969,414 | 1,803,833 | 1,358,247 | |||||||||

| Administrative expenses | 664,677 | 319,133 | 249,148 | |||||||||

| Selling expenses | 853,355 | 551,300 | 454,016 | |||||||||

| Distribution expenses | 331,023 | 121,155 | 103,336 | |||||||||

| Operating income | 2,120,359 | 812,245 | 551,747 | |||||||||

| Financing cost, net(1) | (1,239,230 | ) | (107,411 | ) | (102,301 | ) | ||||||

| Income before income taxes | 881,129 | 704,834 | 449,446 | |||||||||

| Total income taxes | 542,768 | 232,692 | 150,179 | |||||||||

| Net income for the year | Ps. | 338,361 | 472,142 | 299,267 | ||||||||

| (1) | Includes interest expense, interest income, unrealized loss/gain in valuation of derivative financial instruments and foreign exchange loss/gain. |

2

The following table shows the income and share data used in the calculation of basic and diluted earnings per share for the 2020, 2019 and 2018 periods, respectively:

| Net income (in thousands of pesos) | ||||||||||||

| Attributable to shareholders | Ps. | 338,361 | 472,142 | 299,267 | ||||||||

Shares (in thousands of shares) |

||||||||||||

| Weighted average of outstanding shares | ||||||||||||

| Basic | 34,083 | 30,200 | 30,200 | |||||||||

| Diluted | 34,383 | 30,200 | 30,200 | |||||||||

| Basic and diluted earnings per share: | ||||||||||||

| Basic earnings per share (pesos per share) | Ps. | 9.93 | 15.63 | 9.91 | ||||||||

| Diluted earnings per share (pesos per share) | 9.84 | 15.63 | 9.91 | |||||||||

Please see Note 23 of the Audited Consolidated and Combined Financial Statements elsewhere in this annual report for details of the transactions impacting basic and diluted earnings per share for the 2020, 2019 and 2018 periods.

RECONCILIATION OF NON-IFRS MEASURES

Non IFRS Financial Measures

We define “EBITDA” as profit for the year adding back the depreciation of property, plant and equipment and right of use assets, amortization of intangible assets, financing cost, net and total income taxes. Adjusted EBITDA also excludes the effects of gains or losses on sale of fixed assets and adds back other non-recurring expenses. EBITDA and Adjusted EBITDA are not measures required by, or presented in accordance with IFRS. The use of EBITDA and Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for analysis of, our results of operations or financial condition as reported under IFRS.

Betterware believes that these non-IFRS financial measures are useful to investors because (i) Betterware uses these measures to analyze its financial results internally and believes they represent a measure of operating profitability and (ii) these measures will serve investors to understand and evaluate Betterware’s EBITDA and provide more tools for their analysis as it makes Betterware’s results comparable to industry peers that also prepare these measures.

Betterware’s EBITDA and Adjusted EBITDA Reconciliation

| In thousands of Mexican Pesos | January 3, 2021 | December 31, 2019 | December 31, 2018 | |||||||||

| Net Income for the period | Ps. | 338,361 | 472,142 | 299,267 | ||||||||

| Add: Total Income Taxes | 542,768 | 232,692 | 150,179 | |||||||||

| Add: Financing Cost, net | 1,239,230 | 107,411 | 102,301 | |||||||||

| Add: Depreciation and Amortization | 43,688 | 38,394 | 25,960 | |||||||||

| EBITDA | Ps. | 2,164,047 | 850,639 | 577,707 | ||||||||

| Other Adjustments | - | - | - | |||||||||

| Less: Gain on sale of Fixed Assets(1) | - | - | (11,820 | ) | ||||||||

| Add: Non-recurring Expenses(2) | - | - | 7,667 | |||||||||

| Adjusted EBITDA | Ps. | 2,164,047 | Ps. | 850,639 | 573,554 | |||||||

| (1) | Gain on sale of transportation equipment. |

| (2) | Expenses incurred in the year including market penetration analysis, liquidation payment to former employees and licensing implementation of SAS software. |

3

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| D. | RISK FACTORS |

An investment in our ordinary shares carries a significant degree of risk. You should carefully consider the following risk factors, together with all of the other information included in this annual report, before making a decision to invest in our ordinary shares. The risks described below are those which Betterware believes are the material risks that it faces. Some statements in this annual report, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.” If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

Risks Related to Betterware’s Business

If we are unable to retain our existing independent distributors and recruit additional distributors, our results of operations could be negatively affected.

We distribute almost all of our products through our independent distributors and it depends on them directly for the sale of our products. BWM experiences high turnover among distributors from year to year since they terminate their services at any time. As a result, it needs to continue to retain existing and recruit additional independent distributors. To increase its revenue, BWM must increase the number and/or the productivity of our distributors. The number and productivity of BWM’s distributors also depends on several additional factors, including:

| ● | adverse publicity regarding BWM, our products, our distribution channel or its competitors; |

| ● | failure to motivate BWM’s distributors with new products; |

| ● | the public’s perception of BWM’s products; |

| ● | competition for distributors from other direct selling companies; |

| ● | the public’s perception of BWM’s distributors and direct selling businesses in general; and |

| ● | general economic and business conditions. |

BWM’s operations would be harmed if we fail to generate continued interest and enthusiasm among our distributors or we fail to attract new distributors, or if BWM’s distributors are unable to operate due to internal or external factors.

The number of our active distributors, including those at the manager and district director level, may not increase and could decline in the future. BWM’s operating results could be harmed if existing and new business opportunities and products do not generate sufficient interest to retain existing distributors and attract new distributors.

The loss of key high-level distributors could negatively impact Betterware’s consultant growth and our revenue.

As of January 3, 2021, BWM had approximately 1,230,699 active associates and approximately 59,713 distributors, district managers and district directors. The district directors, together with their extensive networks of downline distributors, account for an important part of our net revenue. As a result, the loss of a high-level consultant or a group of leading distributors in the consultant’s network of downline distributors, whether by their own choice or through disciplinary actions by BWM for violations of our policies and procedures, could negatively impact our consultant growth and our net revenue.

4

A decline in our customers’ purchasing power or consumer confidence or in customers’ financial condition and willingness to spend could materially and adversely affect our business.

The sale of home organization products correlates strongly to the level of consumer spending generally, and thus is significantly affected by the general state of the economy and the ability and willingness of consumers to spend on discretionary items. Reduced consumer confidence and spending generally may result in reduced demand for BWM’s products and limitations on our ability to maintain or increase prices. A decline in economic conditions or general consumer spending in any of our major markets could have a material adverse effect on our business, financial condition and results of operations.

Failure of new products to gain distributors and market acceptance could harm Betterware’s business.

An important component of BWM’s business is our ability to develop new products that create enthusiasm among our customers. If we fail to introduce new products planned for the future, our distributors’ productivity could be harmed. In addition, if any new products fail to gain market acceptance, are restricted by regulatory requirements, or have quality problems, this would harm our results of operations. Factors that could affect our ability to continue to introduce new products include, among others, government regulations, proprietary protections of competitors that may limit our ability to offer comparable products and any failure to anticipate changes in consumer tastes and buying preferences.

Betterware’s markets are competitive, and market conditions and the strengths of competitors may harm our business.

The market for BWM’s products is competitive. Our results of operations may be harmed by market conditions and competition in the future. Many competitors have much greater name recognition and financial resources than BWM has, which may give them a competitive advantage. For example, BWM’s products compete directly with branded, premium retail products. BWM currently does not has significant patent or other proprietary protection, and competitors may introduce products with the same ingredients that BWM uses in its products.

Betterware also competes with other companies for distributors. Some of these competitors have a longer operating history, better name recognition and greater financial resources than we do. Some of our competitors have also adopted and could continue to adopt some of BWM’s business strategies. Consequently, to successfully compete in this market and attract and retain distributors, We must ensure that our business opportunities and compensation plans are financially rewarding. BWM may not be able to continue to successfully compete in this market for distributors, which would ultimately, affect our business operations.

If Betterware’s industry, business or our products are subject to adverse publicity, our business may suffer.

Betterware is very dependent upon our distributors’ and the general public’s perception of the overall integrity of our business, as well as the safety and quality of our products and similar products distributed by other companies. The number and motivation of our distributors and the acceptance by the general public of our products may be negatively affected by adverse publicity regarding:

| ● | the legality of network-marketing systems in general or Betterware’s network-marketing system specifically; |

| ● | the safety and quality of our products; |

| ● | regulatory investigations of our products; |

| ● | the actions of our distributors; |

| ● | management of our distributors; and |

| ● | the direct selling industry. |

5

Failure of Betterware’s internet and our other technology initiatives to create sustained consultant enthusiasm and incremental cost savings could negatively impact our business.

We have been developing and implementing a strategy to use the internet to sign up distributors and take orders for our products. In certain demographic markets it has experienced some success using BWM’s internet strategy to improve our operating efficiency. However, any cost savings from our internet strategy may not prove to be significant, or we may not be successful in adapting and implementing the strategy to other markets in which BWM operates. This could result in our inability to service our distributors in the manner they expect.

We are dependent on information and communication technologies, and our systems and infrastructures face certain risks, including cybersecurity risks.

We are dependent on information and communication technologies, and our systems and infrastructures face certain risks, including cybersecurity risks.

The operation of complex infrastructures and the coordination of the many actors involved in our operation require the use of several highly specialized information systems, including both our own information technology systems and those of third-party service providers, such as systems that monitor our operations or the status of our facilities, communication systems to inform the public, access control systems and closed circuit television security systems, infrastructure monitoring systems and radio and voice communication systems used by our personnel. In addition, our accounting and fixed assets, payroll, budgeting, human resources, supplier and commercial, hiring, payments and billing systems and our websites are key to our functioning. The proper functioning of these systems is critical to our operations and business management. These systems may, from time to time, require modifications or improvements as a result of changes in technology, the growth of our business and the functioning of each of these systems.

The risk of cyber-crime continues to augment across all industries and geographies as infiltrating technology is becoming increasingly sophisticated. If we are unable to prevent a significant cyber-attack, such attack could materially disrupt our operations, damage our reputation and lead to regulatory penalties and financial losses. To prevent such disruptions to our operations we have implemented a multi-layer security framework, from strategic corporate policies to operational procedures and controls. To support this framework, we use sophisticated technologies to secure our perimeter, computing equipment, networks, servers, storage and databases.

Information technology systems cannot be completely protected against certain events such as natural disasters, fraud, computer viruses, hacking, communication failures, equipment breakdown, software errors and other technical problems. However, our security framework allows us to minimize and manage these risks through the use of enabling technologies such as, but not limited to, firewalls, mail & web filtering, endpoint protection, antivirus and antimalware, access lists, encryption and hardening.

In addition, our business operations routine involves gathering personal information about vendors, distributors, customers and employees among others, through the use of information technologies. Breaches of our systems or those of our third-party contractors, or other failures to protect such information, could expose such people’s personal information to unauthorized use. Any such event could give rise to a significant potential liability and reputational harm.

During 2020 and 2019, we encountered an increased number of non-material phishing attempts which consisted on fake e-mails requesting minor payments and/or confidential information. As mentioned, none of these attempts were material nor had any major consequences for our operations or our customers. However, we cannot guarantee any future events will not affect our operations or customers.

Because of the costs and difficulties inherent in managing cross-border business operations, the Company’s results of operations may be negatively impacted.

Managing a business, operations, personnel or assets in another country is challenging and costly. Management may be inexperienced in cross-border business practices and unaware of significant differences in accounting rules, legal regimes and labor practices. Even with a seasoned and experienced management team, the costs and difficulties inherent in managing cross-border business operations, personnel and assets can be significant (and much higher than in a purely domestic business) and may negatively impact the Company’s financial and operational performance.

6

BWM’s distributors are independent contractors and not employees. If regulatory authorities were to determine, however, that our distributors are legally BWM employees, BWM could have significant liability under social benefit laws.

BWM’s distributors are self-employed and are not our employees. Periodically, the question of the legal status of our distributors has arisen, usually with regard to possible coverage under social benefit laws that would require BWM to make regular contributions to social benefit funds. We cannot guarantee there will not be a future determination adverse to this criteria, which would substantial and materially adversely affect our business and financial condition.

BWM depends on multiple contract manufacturers mostly located in China, and the loss of the services provided by any of our manufacturers could harm our business and results of operations.

BWM has outsourced product manufacturing functions to third-party contractors mainly located in China. In 2020, products supplied by Chinese manufacturers accounted for approximately 90% of BWM’s revenues.

If these suppliers have unscheduled downtime or are unable to fulfill their obligations under these manufacturing agreements because of political or regulatory restrictions, equipment breakdowns, natural disasters, health diseases or health epidemics, such as the COVID-19 virus, or any other cause, this could adversely affect BWM’s overall operations and financial condition.

Also, although BWM provides all of the formulations used to manufacture our products, BWM has limited control over the manufacturing process itself. As a result, any difficulties encountered by the third-party manufacturer that result in product defects, production delays, cost overruns, or the inability to fulfill orders on a timely basis could have a material adverse effect on our business, financial condition and operating results.

Goodwill, property, plant and equipment and intangible assets represent a significant portion of Betterware’s statement of financial position and our operating results may suffer from possible impairments.

Goodwill, property, plant and equipment and intangible assets in Betterware’s statement of financial position derived from past business combinations carried out by BWM, are further explained in the notes to the consolidated and combined financial statements located elsewhere in this annual report. Goodwill and intangible assets with indefinite useful lives are tested for impairment at least annually. Property, plant and equipment and intangible assets with definite useful lives are tested for impairment whenever there is an indication that these assets may be impaired. In the case of an impairment, we will recognize charges to our operating results based on the impairment assessment processes. In addition, future acquisitions may be made by BWM and a portion of the purchase price of these acquisitions may be allocated to acquired goodwill, property, plant and equipment and intangible assets. An impairment on property, plant and equipment or goodwill of acquired businesses could have a material adverse effect on our financial condition and results of operations.

The COVID-19 virus (nCoV), as well as any other public health crises that may arise in the future, is having and will likely continue to have a negative impact on our gross margins and in our results of operation.

In late December 2019, a notice of pneumonia of unknown cause originating from Wuhan, Hubei province of China was reported to the World Health Organization. A novel COVID-19 virus (nCoV) was identified, with cases soon confirmed in multiple provinces in China, as well as in several other countries. The Chinese government placed Wuhan and multiple other cities in Hubei province under quarantine, with approximately 60 million people affected. On March 11, 2020, the World Health Organization declared the coronavirus outbreak a pandemic. The ongoing COVID-19 has resulted in several cities be placed under quarantine, increased travel restrictions from and to several countries, such as the U.S., China, Italy, Spain and Mexico which had forced extended shutdowns of certain businesses in certain regions.

The COVID-19 pandemic continues to impact worldwide economic activity and pose the risk that we or our employees, contractors, suppliers, customers and other business partners may be prevented from conducting certain business activities for an indefinite period of time, including due to shutdowns that may be requested or mandated by governmental authorities or otherwise elected by companies as a preventive measure. In addition, mandated government authority measures or other measures elected by companies as a preventive measure may lead to our consumers being unable to complete purchases or other activities. Its impact on the global and local economies may also adversely impact consumer discretionary spending.

7

Although our operations were not interrupted as a result of the COVID-19 pandemic, our gross margin was negatively affected by the depreciation of the Mexican peso compared to the US dollar, as we acquire most of our products in US dollars. This affected and will likely continue affecting our results of operations for so long as the COVID-19 pandemic continues to impact global and local economies.

Material weaknesses have been identified in Betterware’s internal control over financial reporting, and if we fail to establish and maintain proper and effective internal controls over financial reporting, our results of operations and our ability to operate our business may be harmed.

We are in the process of implementing Internal Control—Integrated Framework (2013 Framework) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and as of January 3, 2021 management has identified material weaknesses associated with the components of COSO. See “Disclosure Controls and Procedures—Control and Procedures.”

Betterware’s controlling shareholder may have interests that conflict with your interests.

As of January 3, 2021, Campalier owns approximately 51.57% of the outstanding common stock of Betterware. As the controlling shareholder, Campalier may take actions that are not in the best interests of the Company’s other shareholders. These actions may be taken in many cases even if they are opposed by the Company’s other shareholders. In addition, this concentration of ownership may discourage, delay or prevent a change in control which could deprive you of an opportunity to receive a premium for your Ordinary Shares as part of a sale of the Company.

Our business and results of operations may be adversely affected by the increased strain on our resources from complying with the reporting, disclosure and other requirements applicable to public companies in the United States promulgated by the U.S. Government, Nasdaq or other relevant regulatory authorities.

Compliance with existing, new and changing corporate governance and public disclosure requirements adds uncertainty to our compliance policies and increases our costs of compliance. Changing laws, regulations and standards include those relating to accounting, corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Sarbanes-Oxley Act of 2002, new SEC regulations and the Nasdaq listing guidelines. These laws, regulations and guidelines may lack specificity and are subject to varying interpretations. Their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. In particular, compliance with Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”) and related regulations regarding required assessment of internal controls over financial reporting and our external auditor’s audit of that assessment, requires the commitment of significant financial and managerial resources. We also expect the regulations to increase our legal and financial compliance costs, making it more difficult to attract and retain qualified officers and members of our board of directors, particularly to serve on our audit committee, and make some activities more difficult, time-consuming and costly.

Existing, new and changing corporate governance and public disclosure requirements could result in continuing uncertainty regarding compliance matters and higher costs of compliance as a result of ongoing revisions to such governance standards. Our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses. In addition, new laws, regulations and standards regarding corporate governance may make it more difficult for our company to obtain director and officer liability insurance. Further, our board members and senior management could face an increased risk of personal liability in connection with their performance of duties. As a result, we may face difficulties attracting and retaining qualified board members and senior management, which could harm our business. If we fail to comply with new or changed laws or regulations and standards differ, our business and reputation may be harmed.

8

Risks Related to Mexico

Currency exchange rate fluctuations, particularly with respect to the US dollar/Mexican peso exchange rate, could lower margins.

The value of the Mexican peso has been subject to significant fluctuations with respect to the U.S. dollar in the past and may be subject to significant fluctuations in the future. Historically, BWM has been able to raise their prices generally in line with local inflation, thereby helping to mitigate the effects of devaluations of the Mexican peso. However, BWM may not be able to maintain this pricing policy in the future, or future exchange rate fluctuations may have a material adverse effect on our ability to pay suppliers.

Given Betterware’s inability to predict the degree of exchange rate fluctuations, it cannot estimate the effect these fluctuations may have upon future reported results, product pricing or our overall financial condition. Although we attempt to reduce our exposure to short-term exchange rate fluctuations by using foreign currency exchange contracts, it cannot be certain that these contracts or any other hedging activity will effectively reduce exchange rate exposure. In particular, BWM currently employs a hedging strategy comprised of forwards U.S. dollar–Mexican peso derivatives that are designed to protect us against devaluations of the Mexican peso. As of the date of this annual report, the hedging contracts cover 100% of the product needs as of November 2021. In addition, We generally purchase our hedging instruments on a rolling twelve-month basis; instruments protecting it to the same or a similar extent may not be available in the future on reasonable terms. Unprotected declines in the value of the Mexican peso against the U.S. dollar will adversely affect our ability to pay our dollar-denominated expenses, including our supplier obligations.

Any adverse changes in BWM’s business operations in Mexico would adversely affect our revenue and profitability.

BWM’s revenue is generated in Mexico. Various factors could harm BWM’s business in Mexico. These factors include, among others:

| ● | worsening economic conditions, including a prolonged recession in Mexico; |

| ● | fluctuations in currency exchange rates and inflation; |

| ● | longer collection cycles; |

| ● | potential adverse changes in tax laws; |

| ● | changes in labor conditions; |

| ● | burdens and costs of compliance with a variety of laws; |

| ● | political, social and economic instability; |

| ● | increases in taxation; and |

| ● | outbreaks of disease and health epidemics, such as the COVID-19 virus. |

Economic and political developments in Mexico and the United States may adversely affect Mexican economic policy.

Economic conditions in Mexico are highly correlated with economic conditions in the United States due to the physical proximity and the high degree of economic activity between the two countries generally, including the trade facilitated by USMCA, the successor agreement to NAFTA. As a result, political developments in the United States, including changes in the administration and governmental policies, can also have an impact on the exchange rate between the U.S. dollar and the Mexican peso, economic conditions in Mexico and the global capital markets.

9

Mexico is an emerging market economy, with attendant risks to BWM’s results of operations and financial condition.

The Mexican government has exercised, and continues to exercise, significant influence over the Mexican economy. Accordingly, Mexican governmental actions concerning the economy and state-owned enterprises could have a significant impact on Mexican private sector entities in general, as well as on market conditions, prices and returns on Mexican securities. The national elections held on July 2, 2018 ended six years of rule by the Institutional Revolutionary Party or PRI with the election of President Andres Manuel Lopez Obrador, a member of the Morena Party, and resulted in the increased representation of opposition parties in the Mexican Congress and in mayoral and gubernatorial positions. Multiparty rule is still relatively new in Mexico and could result in economic or political conditions that could materially and adversely affect BWM’s operations. BWM cannot predict the impact that this new political landscape will have on the Mexican economy. Furthermore, BWM’s financial condition, results of operations and prospects and, consequently, the market price for our shares, may be affected by currency fluctuations, inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Mexico.

The Mexican economy in the past has suffered balance of payment deficits and shortages in foreign exchange reserves. There are currently no exchange controls in Mexico; however, Mexico has imposed foreign exchange controls in the past. Pursuant to the provisions of the United States-Mexico-Canada Agreement, if Mexico experiences serious balance of payment difficulties or the threat thereof in the future, Mexico would have the right to impose foreign exchange controls on investments made in Mexico, including those made by U.S. and Canadian investors.

Securities of companies in emerging market countries tend to be influenced by economic and market conditions in other emerging market countries. Emerging market countries, including Argentina and Venezuela, have recently been experiencing significant economic downturns and market volatility. These events could have adverse effects on the economic conditions and securities markets of other emerging market countries, including Mexico.

Political and social events in Mexico could adversely affect our business.

Mexico will hold federal and local intermediate elections on June 6, 2021. Due to the fact that the Partido Movimiento Regeneración Nacional (Morena), has majority in both houses of congress, the Party, and therefore the President of Mexico, has substantial power to approve new laws, amend existing ones and freely determine the policies and governmental actions including those related to the country’s economy and therefore affect or impact the operations and financial results of Mexican companies. We cannot predict what the result of the elections will bring regarding the integration of congress and the ruling party’s ability to maintain its current ability to dictate and implement public policies. The uncertainty associated with the result of the election and the result itself may adversely affect our operations and financial condition.

Investments in Mexican companies entail substantial risk; the Mexican government has exercised, and continues to exercise, an important influence on the Mexican economy

Investments in Mexico carry significant risks, including the risk of expropriation or nationalization laws being enacted or imposing exchange controls, taxes, inflationary, hyperinflationary, exchange rate risk, credit risk, among other governmental or political restrictions. We are incorporated under the laws of Mexico and most of our operations and assets are located in Mexico. As a consequence of the foregoing, our financial situation and operating results could be negatively affected.

The Mexican government has exercised, and continues to exercise, a strong influence on the country’s economy. Consequently, Mexican federal government actions and policies related to the economy, state-owned and controlled companies, and financial institutions financed or influenced, could have a significant impact on private sector entities in general, including us, in particular and on market conditions, prices and returns on Mexican securities, including counterparty risk. The Mexican federal government has made major policy and regulatory changes and may do so again in the future. Actions to control inflation and other regulations and policies have involved, among other measures, an increase in interest rates, changes in fiscal policies, price controls, currency devaluations, capital controls and limits on imports. Tax and labor legislation, in particular, in Mexico is subject to continuous change, and we cannot guarantee that the Mexican government will maintain current economic or other policies in force or if any the changes to such laws and policies would have a material adverse effect on us or on our financial performance. The measures adopted by the government could have a significant effect on private sector entities in general, as well as on the market situation and on the price of our shares.

10

Additionally, the Mexican federal government has implemented protectionist policies in the past and could implement certain national policies in the future that could restrict our operations, including restrictions on imports from certain countries.

Mexico may experience high levels of inflation in the future, which could affect BWM’s results of operations.

During most of the 1980s and during the mid- and late-1990s, Mexico experienced periods of high levels of inflation, although the country has had stable inflation during the last five years. The annual rates of inflation for the last five years as measured by changes in the National Consumer Price Index, as provided by Banco de Mexico, were:

| 2020 | 3.1 | % | |

| 2019 | 2.8 | % | |

| 2018 | 4.8 | % |

A substantial increase in the Mexican inflation rate would have the effect of increasing some of BWM’s costs, which could adversely affect our results of operations and financial condition.

Mexico has experienced a period of increasing criminal activity, which could affect the Company’s operations.

In recent years, Mexico has experienced a period of increasing criminal activity, primarily due to the activities of drug cartels and related criminal organizations. In response, the Mexican Government has implemented various security measures and has strengthened its military and police forces aimed at decreasing incidents of theft and other criminal activity. Despite these efforts, criminal activity continues to exist in Mexico. These activities, their possible escalation and the violence associated with them, in an extreme case, may have a negative impact on the Company’s financial condition and results of operations.

The regulatory environment in which Betterware operates is evolving, and our operations may be modified or otherwise harmed by regulatory changes, subjective interpretations of laws or an inability to work effectively with national and local government agencies.

Although BWM reviews applicable local laws in developing our plans, our efforts to comply with them may be harmed by an evolving regulatory climate and subjective interpretation of laws by the authorities. Any determination that BWM’s operations or activities are not in compliance with applicable regulations could negatively impact our business and our reputation with regulators in the markets in which we operate.

Laws and regulations may restrict Betterware’s direct sales efforts and harm our revenue and profitability.

Various government agencies throughout the world regulate direct sales practices. These laws and regulations are generally intended to prevent fraudulent or deceptive schemes, often referred to as “pyramid” schemes, that compensate participants for recruiting additional participants irrespective of product sales and/or which do not involve legitimate products. The laws and regulations in BWM’s current markets often:

| ● | impose on it order cancellations, product returns, inventory buy-backs and cooling-off rights for consumers and distributors; |

| ● | require us or our distributors to register with governmental agencies; |

| ● | impose on it reporting requirements to regulatory agencies; and/or |

| ● | require it to ensure that distributors are not being compensated solely based upon the recruitment of new distributors. |

Complying with these sometimes inconsistent rules and regulations can be difficult and requires the devotion of significant resources on BWM’s part.

In addition, Mexico could change its laws or regulations to negatively affect or prohibit completely network or direct sales efforts. Government agencies and courts in Mexico may also use their powers and discretion in interpreting and applying laws in a manner that limits BWM’s ability to operate or otherwise harms our business. If any governmental authority were to bring a regulatory enforcement action against BWM that interrupts BWM’s business, our revenue and earnings would likely suffer.

11

You may have difficulty enforcing your rights against Betterware and our directors and executive officers.

Betterware is a company incorporated in Mexico. All our directors and executive officers are non-residents of the U.S. You may be unable to effect service of process within the U.S. on Betterware, its directors and executive officers. In addition, as all of our assets and substantially all of the assets of our directors and executive officers are located outside of the U.S., you may be unable to enforce against BWM and our directors and executive officers judgments obtained in the U.S. courts, including judgments predicated upon civil liability provisions of the U.S. federal securities laws or state securities laws. There is also doubt as to the enforceability, in original actions in Mexican courts, of liabilities including those predicated solely on U.S. federal securities laws and as to the enforceability in Mexican courts of judgments of U.S. courts obtained in actions, including those predicated upon the civil liability provisions of U.S. federal securities laws. There is no bilateral treaty currently in effect between the United States and Mexico that covers the reciprocal enforcement of civil foreign judgments. In the past, Mexican courts have enforced judgments rendered in the United States by virtue of the legal principles of reciprocity and comity, consisting of the review in Mexico of the United States judgment, in order to ascertain, among other matters, whether Mexican legal principles of due process and public policy (orden público) have been complied with, without reviewing the merits of the subject matter of the case.

Risks Related to Ownership of our Ordinary Shares

As a “foreign private issuer” under the rules and regulations of the SEC, Betterware is permitted to, and is expected to, file less or different information with the SEC than a company incorporated in the United States or otherwise subject to these rules, and is expected to follow certain home country corporate governance practices in lieu of certain Nasdaq requirements applicable to U.S. issuers.

Betterware is considered a “foreign private issuer” under the Exchange Act and therefore exempt from certain rules under the Exchange Act, including the proxy rules, which impose certain disclosure and procedural requirements for proxy solicitations for U.S. and other issuers. Moreover, the Company is not required to file periodic reports and financial statements with the SEC as frequently or within the same time frames as U.S. companies with securities registered under the Exchange Act. We currently prepare our financial statements in accordance with IFRS. The Company is not required to file financial statements prepared in accordance with or reconciled to U.S. GAAP so long as our financial statements are prepared in accordance with IFRS. The Company is not required to comply with Regulation FD, which imposes restrictions on the selective disclosure of material information to shareholders. In addition, the Company’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of Company securities.

In addition, as a “foreign private issuer” whose shares are listed on Nasdaq, the Company is permitted to, and is expected to, follow certain home country corporate governance practices in lieu of certain Nasdaq requirements. A foreign private issuer must disclose in its annual reports filed with the SEC each Nasdaq requirement with which it does not comply followed by a description of its applicable home country practice. As a Mexican corporation listed on Nasdaq, the Company is expected to follow our home country practice with respect to the composition of the board of directors and nominations committee and executive sessions. Unlike the requirements of Nasdaq, the corporate governance practices and requirements in Mexico do not require the Company to have a majority of its board of directors to be independent; do not require the Company to establish a nominations committee; and do not require the Company to hold regular executive sessions where only independent directors shall be present. Such home country practices of Mexico may afford less protection to holders of Company shares.

The Company could lose its status as a “foreign private issuer” under current SEC rules and regulations if more than 50% of the Company’s outstanding voting securities become directly or indirectly held of record by U.S. holders and one of the following is true: (i) the majority of the Company’s directors or executive officers are U.S. citizens or residents; (ii) more than 50% of the Company’s assets are located in the United States; or (iii) the Company’s business is administered principally in the United States. If the Company loses its status as a foreign private issuer in the future, it will no longer be exempt from the rules described above and, among other things, will be required to file periodic reports and annual and quarterly financial statements as if it were a company incorporated in the United States. If this were to happen, the Company would likely incur substantial costs in fulfilling these additional regulatory requirements and members of the Company’s management would likely have to divert time and resources from other responsibilities to ensuring these additional regulatory requirements are fulfilled.

12

Betterware qualifies as an emerging growth company within the meaning of the Securities Act, and if it takes advantage of certain exemptions from disclosure requirements available to emerging growth companies, which could make the Company’s securities less attractive to investors and may make it more difficult to compare the Company’s performance to the performance of other public companies.

Betterware qualifies as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act, as modified by the JOBS Act. As such, the Company is eligible for and intends to take advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies for as long as it continues to be an emerging growth company, including (i) the exemption from the auditor attestation requirements with respect to internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act, (ii) the exemptions from say-on-pay, say-on-frequency and say-on-golden parachute voting requirements and (iii) reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements. The Company will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which the market value of our ordinary shares that are held by non-affiliates exceeds $700 million as of June 30 of that fiscal year, (ii) the last day of the fiscal year in which it has total annual gross revenue of $1.07 billion or more during such fiscal year (as indexed for inflation), (iii) the date on which it has issued more than $1 billion in non-convertible debt in the prior three-year period or (iv) the last day of the fiscal year following the fifth anniversary of the date of the first sale of DD3’s ordinary shares in its initial public offering. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the exemption from complying with new or revised accounting standards provided in Section 7(a)(2)(B) of the Securities Act as long as the Company is an emerging growth company. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. DD3 has elected not to opt out of such extended transition period and, therefore, the Company may not be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies. Investors may find the Company shares less attractive because the Company will rely on these exemptions, which may result in a less active trading market for the Company shares and their price may be more volatile.

If securities or industry analysts do not publish or cease publishing research or reports about Betterware, our business, or markets, or if they change their recommendations regarding the Company shares adversely, the price and trading volume of the Company shares could decline.

The trading market for the Company shares is influenced by the research and reports that industry or securities analysts may publish about the Company, our business, market or competitors. Securities and industry analysts do not currently, and may never, publish research on the Company. If no securities or industry analysts commence coverage of the Company, the price and trading volume of the Company shares would likely be negatively impacted. If any of the analysts who may cover the Company change their recommendation regarding the Company shares adversely, or provide more favorable relative recommendations about the Company’s competitors, the price of the Company shares would likely decline. If any analyst who may cover the Company were to cease coverage of the Company or fail to regularly publish reports on it, the Company could lose visibility in the financial markets, which in turn could cause our share price or trading volume to decline.

There can be no assurance that Betterware will be able to comply with the continued listing standards of Nasdaq.

Betterware’s shares are listed on Nasdaq under the symbol “BWMX.” If Nasdaq delists the Company’s securities from trading on its exchange for failure to meet the listing standards, the Company and its shareholders could face significant material adverse consequences including:

| ● | a limited availability of market quotations for the Company’s securities; |

| ● | a determination that the Company shares are “penny stock” which will require brokers trading in the Company shares to adhere to more stringent rules, possibly resulting in a reduced level of trading activity in the secondary trading market for the Company shares; |

| ● | a limited amount of analyst coverage; and |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

13

If Betterware is characterized as a passive foreign investment company, or a PFIC, adverse U.S. federal income tax consequences may result for U.S. holders of Company shares.