UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For

the Fiscal Period Ended

OR

For the transition period from __________ to __________

OR

Date of event requiring this shell company report __________

Commission

file number

.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+52

Colonia Belenes Norte

(Name, Telephone, E-mail and or Facsimile number and Address Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange in which registered | ||

| The |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate

the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered

by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐

Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐

Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Non-accelerated filer ☐ | |

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐

Yes

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains a number of forward-looking statements, including statements about the financial conditions, results of operations, earnings outlook and prospects and may include statements for the period following the date of this annual report. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of the Company (See “Presentation of Financial Information”), as applicable, and are inherently subject to uncertainties and changes in circumstance and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Given these uncertainties, you should not rely upon forward looking statements as predictions of future events. These risks and uncertainties include, but are not limited to, those factors described in “Risk Factors,” those discussed and identified in public filings made with the Securities and Exchange Commission (“SEC”) by Betterware and the following:

| ● | the inability to profitably expand into new markets; |

| ● | the possibility that the Group may be adversely affected by external economic, business and/ or competitive factors; |

| ● | operational risk; |

| ● | financial performance; |

| ● | litigation and regulatory enforcement risks, including the diversion of management time and attention and the additional costs and demands on the Group’s resources; |

| ● | changes in our investment commitments or our ability to meet our obligations thereunder; |

| ● | natural disaster-related losses which may not be fully insurable; |

| ● | epidemics, pandemics and other public health crises, particularly the COVID-19 pandemic; |

| ● | geopolitical risk and changes in applicable laws or regulations; |

| ● | fluctuations in exchange rates between the peso and the U.S. dollar; and |

| ● | changes in interest rates or foreign exchange rates. |

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of the Company prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Except to the extent required by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this annual report or to reflect the occurrence of unanticipated events.

ii

CERTAIN CONVENTIONS

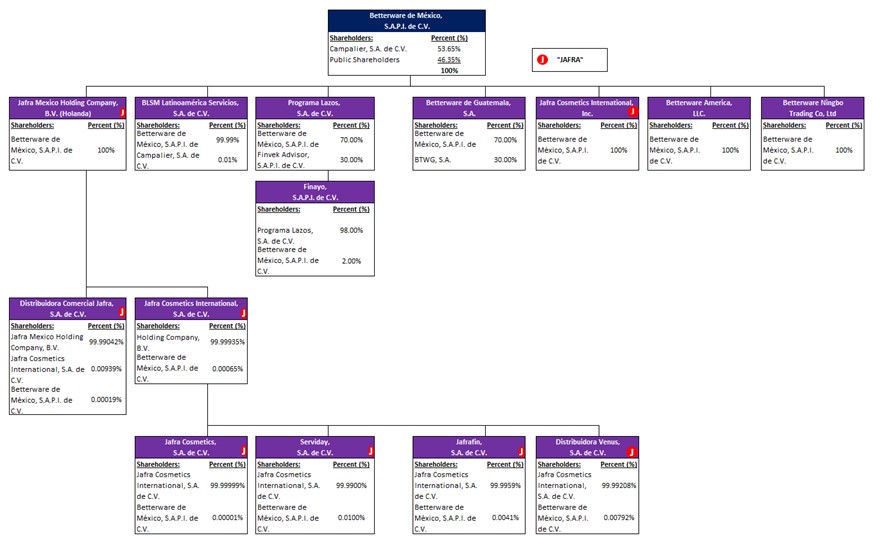

Betterware de México, S.A.P.I. de C.V. (formerly Betterware de México, S.A.B. de C.V.), a Mexican sociedad anónima promotora de inversión de capital variable, was incorporated under the laws of Mexico in 1995. Unless otherwise stated or unless the context otherwise requires, the terms (i) “we,” “us,” “our,” “Company,” the “Group” refer to Betterware de México, S.A.P.I. de C.V. and subsidiaries on a consolidated basis, (ii) “Betterware,” “BTW,” “BWM” and “BW” refer to Betterware de México, S.A.P.I. de C.V. on a standalone basis, and (iii) “JAFRA” or “Jafra” refers to Jafra Cosmetics International, Inc., Jafra Mexico Holding Company, B.V., Distribuidora Comercial Jafra, S.A. de C.V., Jafra Cosmetics International, S.A. de C.V., Jafra Cosmetics, S.A. de C.V., Serviday, S.A. de C.V., Jafrafin, S.A. de C.V. and Distribuidora Venus, S.A. de C.V., on a consolidated basis. See “Company Information—Organizational Structure.”

CURRENCY PRESENTATION

In this annual report, unless otherwise specified or the context otherwise requires:

| ● | “$,” “US$” and “U.S. dollar” each refer to the United States dollar; and |

| ● | “MX$,” “Ps.” and “peso” each refer to the Mexican peso. |

Certain numbers and percentages included in this annual report have been subject to rounding adjustments. Accordingly, figures shown for the same category presented in various tables or other sections of this annual report may vary slightly, and figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them.

PRESENTATION OF FINANCIAL INFORMATION

This annual report contains our Audited Consolidated Financial Statements as of December 31, 2022 and 2021, and for the year ended December 31, 2022 (the “2022 period”) and 2021 (the “2021 period”), and the 53 weeks ended January 3, 2021 (the “2020 period”) (collectively, our “Audited Consolidated Financial Statements”).

Until and including the 2020 period, Betterware’s financial year was a 52- or 53-weeks period ending on the Sunday nearest to December 31. However, due to the fact that in 2021 Betterware issued debt on the Mexican Stock Exchange and in order to comply with the Mexican General Corporate Law, our financial period is required to end on the last day of the calendar year. Therefore, the financial information for the 2022 and 2021 periods is presented as of December 31, 2022 and December 31, 2021, respectively, and for the years then ended. The comparative financial year of 2020 consisted of 53 weeks ended on January 3, 2021, but was not adjusted to calendar year because the effects of the change are not significant.

During the preparation of the Company’s consolidated financial statements as of and for the 2022 period, management concluded that certain prior year errors that were deemed to be immaterial, on an individual and aggregate basis, to the Company’s previously reported consolidated financial statements as of and for the 2021 period under the SEC’s Staff Accounting Bulletin No. 99, could not be corrected on an out-of-period basis in the current year financial statements because to do so would cause a material misstatement in those financial statements. Due to the decrease in profit before taxes from 2021 to 2022, materiality levels in the 2022 period for accounting purposes decreased to approximately half of the materiality levels established in the 2021 period. Therefore, the Company referred to the guidance prescribed by the SEC’s Staff Accounting Bulletin No. 108 which specifies, among other things, that the errors must be corrected as an immaterial restatement of the prior year financial statements the next time those financial statements are filed. See “Operating and Financial Review and Prospects—Previously Issued Financial Statement Corrections.”

For purposes of this annual report, the term fiscal year is synonymous with financial year and refers to the periods covered by our Audited Consolidated Financial Statements.

We

prepare our Audited Consolidated Financial Statements in accordance with International Financial Reporting Standards

(“IFRS”), as issued by the International Accounting Standards Board (“IASB”). We have applied IFRS issued by

the IASB effective at the time of preparing our Audited Consolidated Financial Statements. Our Audited Consolidated Financial

Statements for the 2022 period have been audited by PricewaterhouseCoopers, S. C. (“PWC”), and independent registered

public accounting firm, whose report dated May 15, 2023, is also included in this annual report. Our Audited Consolidated Financial

Statements for the 2021 and 2020 periods were audited by Galaz, Yamazaki, Ruiz Urquiza, S.C. member of

iii

The Audited Consolidated Financial Statements include the position and results of operations of the Group formed by Betterware, BLSM Latino America Servicios, S.A. de C.V. (“BLSM”), GurúComm, S.A.P.I. de C.V., Innova Catálogos, S.A. de C.V., Programa Lazos, S.A. de C.V., Betterware de Guatemala, S.A., Finayo, S.A.P.I. de C.V. SOFOM ENR, and JAFRA (See “The Business Combination—Organizational Structure”). The transactions, balances and unrealized gains or losses arising from intra-group transactions have not been considered for the preparation of the Audited Consolidated Financial Statements.

Our Audited Consolidated Financial Statements are presented in thousands of Pesos.

Non-IFRS Measures

We define “EBITDA” as profit for the year adding back the depreciation of property, plant and equipment and right-of-use assets, amortization of intangible assets, financing cost, net and total income taxes. EBITDA is not measure required by or presented in accordance with IFRS. The use of EBITDA has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for analysis of, our results of operations or financial condition as reported under IFRS.

The Group believes that this non-IFRS financial measure is useful to investors because (i) The Group uses this measure to analyze its financial results internally and believes it represents a measure of operating profitability and (ii) this measure will serve investors to understand and evaluate the Group’s EBITDA and provide more tools for their analysis as it makes the Group’s results comparable to industry peers that also use this metric. See “Operating and Financial Review and Prospects—Operating Results—Reconciliation Of Non-IFRS Measures.”

The Business Combination

The Initial Public Offering

On October 16, 2018, DD3 Acquisition Corp., a British Virgin Islands company (“DD3”), consummated its initial public offering of 5,000,000 units and on October 23, 2018, the underwriters for DD3’s initial public offering purchased an additional 565,000 units pursuant to the partial exercise of their over-allotment option. The units in DD3’s initial public offering were sold at an offering price of US$10.00 per unit, generating total gross proceeds of US$55,650,000.

The Merger

On August 2, 2019, DD3 entered into a Combination and Stock Purchase Agreement (as amended, the “Combination and Stock Purchase Agreement”) with Campalier, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Campalier”), Promotora Forteza, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Forteza”), Strevo, S.A. de C.V., a Mexican sociedad anónima de capital variable (“Strevo”, and together with Campalier and Forteza, “Sellers”), Betterware, BLSM, and, solely for the purposes of Article XI therein, DD3 Mex Acquisition Corp, S.A. de C.V., pursuant to which DD3 agreed to merge with and into Betterware (the “Merger”) in a Business Combination that resulted in Betterware surviving the Merger and BLSM becoming a wholly-owned subsidiary of Betterware.

As part of the Combination and Stock Purchase Agreement, and prior to the closing of the Merger, DD3 was redomiciled out of the British Virgin Islands and continued as a Mexican corporation pursuant to Section 184 of the Companies Act and Article 2 of the Mexican General Corporations Law.

Betterware’s Restructure

Following the execution of the Combination and Stock Purchase Agreement, on February 21, 2020, Betterware’s shareholders approved, a corporate restructure in Betterware (the “Betterware Restructure”) which implied, among other things (i) Betterware’s by-laws amendment in order to issue Series C and Series D non-voting shares, and (ii) a redistribution of Betterware’s capital stock as follows: (a) fixed portion of Betterware’s capital stock represented by 3,075,946, Series A, ordinary voting shares, and (b) the variable portion of Betterware’s capital stock represented by (x) 1,961,993, Series B, ordinary voting shares, (y) 897,261, Series C, ordinary non-voting shares (“Series C Shares”), and (z) 168,734, Series D, ordinary non-voting shares (“Series D Shares”). In addition, Strevo transferred one Series A ordinary voting share of Betterware to Campalier (the “Campalier Share”), which remained under certain Share Pledge Agreement, dated July 28, 2017, entered between Strevo, as pledgor, MCRF P, S.A. de C.V. SOFOM, E.N.R. (“CS”), as pledgee, and Betterware.

iv

Immediately after consummation of Betterware Restructure and the transfer of the Campalier Share to Campalier, Forteza indirectly, through Banco Invex, S.A., Invex Grupo Financiero (“Invex”), as trustee of the irrevocable management and security trust No. 2397 (the “Invex Security Trust”), dated March 26, 2016, owned approximately 38.94% of the outstanding common stock of Betterware, and Campalier indirectly, through the Invex Security Trust, owned approximately 61.06% of the outstanding common stock of Betterware.

On March 9, 2020, the Invex Security Trust released the Series C Shares and the Series D Shares to Campalier and Forteza, respectively, that were held under the Invex Security Trust.

On March 10, 2020, CS, as pledgee, entered into a Termination of the Share Pledge Agreement over the Campalier Share with Campalier, as pledgor, and Betterware. In addition, CS, as beneficiary, Invex, as trustee, and Campalier, as settlor, entered into a Transfer Agreement, where Campalier transferred the Campalier Share to the Invex Security Trust.

Upon such transfer to the Invex Security Trust, Betterware’s shareholders approved (i) the sale of all or a portion of such Betterware’s Series C and Series D shares to DD3 Acquisition Corp., S.A. de C.V. (the “DD3 Acquisition”), (ii) the Merger, (iii) the amendment of Betterware’s by-laws to become a sociedad anónima promotora de inversion de capital variable, (iv) the increase of Betterware’s capital stock by MX$94,311,438.00, through the issuance of 2,211,075 ordinary shares, without nominal value, subscribed by the shareholders of DD3 Acquisition Corp., S.A. de C.V., and (v) the increase of Betterware’s capital stock by MX$872,878,500.00 through the issuance of 4,500,000 ordinary treasury shares without nominal value, offered for subscription and payment under Betterware’s public offering in the U.S. completed and filed with the SEC under our Registration Statement on Form F-1, which became effective on January 22, 2020. On March 10, 2020, Betterware’s corporate name changed from Betterware de México, S.A. de C.V. to Betterware de México, S.A.P.I. de C.V.

The DD3 Acquisition was closed on March 13, 2020, and as a result, all of Betterware shares that were issued and outstanding immediately prior to the closing date were canceled and new shares were issued. The DD3 Acquisition was accounted as a capital reorganization, whereby Betterware issued shares to the DD3 shareholders and obtained US$22,767 (Ps.498,445) in cash through the acquisition of DD3 and, simultaneously settled liabilities and related transaction costs on that date, for net cash earnings of US$7,519 (Ps.181,734) on such date. In addition, Betterware assumed the obligation of the warrants issued by DD3, a liability inherent to the transaction, equivalent to the fair value of Ps.55,810 of the warrants. No other assets or liabilities were transferred as part of the transaction that required adjustment to fair value as a result of the acquisition.

On the same date, a total of 2,040,000 of Betterware shares, that were offered for subscription and payment under its public offering on Nasdaq Capital Market (“Nasdaq”), were subscribed and paid for by various investors.

On July 14, 2020, Betterware’s corporate name changed from Betterware de México, S.A.P.I. de C.V. to Betterware de México, S.A.B. de C.V. For purposes of this annual report, the Merger, the Betterware Restructure and all related actions undertaken in connection thereto are referred to as the “Business Combination.”

Closing of the Business Combination

Upon satisfaction of certain conditions and covenants as set forth under the Combination and Stock Purchase Agreement, the Business Combination was consummated and closed on March 13, 2020 (the “Closing”). At Closing, the following actions occurred:

| (i) | DD3 issued to the Sellers as consideration for the purchase of a portion of the Series C and Series D shares and the BLSM shares outstanding as of January 3, 2021, a debt acknowledgement in an amount equal to $15,000,546. |

| (ii) | all of Betterware shares issued and outstanding immediately prior to the Closing were canceled and, Campalier and Forteza received, directly and indirectly (through the Invex Security Trust), 18,438,770 and 11,761,175, respectively, of Betterware’s shares; and |

| (iii) | all of DD3’s ordinary shares issued and outstanding immediately prior to the Closing were canceled and exchanged for Betterware shares on a one-for-one basis. |

v

On the Closing date, 2,040,000 shares of Betterware offered for subscription and payment under Betterware’s public offering in the U.S. on the Nasdaq were subscribed and paid for by various investors.

As part of the Merger, Betterware assumed an obligation that granted existing warrant holders the option to purchase (i) a total of 5,804,125 Betterware shares at a price of US$11.50 per share that would expire on or before March 25, 2025, and (ii) a total of 250,000 units that automatically became an option to issue 250,000 Betterware shares and warrants to buy 250,000 additional Betterware shares. Betterware registered the warrants to be traded on OTC Markets, which had an observable fair value. The following events occurred in 2020 as part of the warrants agreement:

| (i) | During July and August 2020, Betterware repurchased 1,573,888 warrants. During August and October 2020, 895,597 warrants were exchanged for 621,098 shares, of which, 462,130 warrants were settled on a cash basis by exchanging 1 warrant for 1 share at a price of US$11.44 for share, which resulted in receiving cash by an amount of Ps.116,419. The remaining 433,467 warrants were exchanged on a cashless basis by exchanging 1 warrant for 0.37 shares. |

| (ii) | In September 2020, the purchase option of units was exercised by their holders on a cashless basis, which resulted in the issuance of 214,020 Betterware shares. |

| (iii) | Additionally, in October 2020, and as part of the terms of the warrant agreement, Betterware exercised the redemption of the warrants on a cashless basis by exchanging 3,087,022 warrants for 1,142,325 of Betterware’s shares. A total of 8,493 public warrants were not exercised by their holders during the redemption period that expired on November 9, 2020, therefore, they were paid by Betterware for a price of US$0.01 per warrant. |

| (iv) | In December 2020, holders exercised a total of 239,125 private warrants on a cashless basis and exchanged for 156,505 of Betterware’s shares. |

| (v) | As of the January 3, 2021, the warrant holders redeemed all of the outstanding warrants and purchase option of units and Betterware recognized a loss for the increase in the fair value of the warrants of Ps.851,520, which was recognized under the heading “Loss in valuation of warrants” in the consolidated and combined statement of profit or loss. As of the date of this annual report, all of the warrants have been redeemed. |

On August 2, 2021, Betterware’s corporate name changed from Betterware de México, S.A.B. de C.V. to Betterware de México, S.A.P.I. de C.V.

The Forteza Merger

On December 14, 2020, Betterware and Forteza (Betterware’s shareholder), entered into a merger agreement pursuant to which Forteza agreed to merge with and into Betterware, surviving Betterware as the acquiror (the “Forteza Merger”). On December 16, 2020, the merger was consummated. Consequently, shares in Betterware were delivered to Forteza’s shareholders in proportion to their shareholding in Betterware, without implying an increase in our share capital or in the total number of outstanding shares of Betterware.

Other Transactions during 2020

On December 3, 2020, we acquired 70% of the shares of Betterware de Guatemala, S.A., a company focused on the distribution of our line of products and providing home solutions in Guatemala.

On December 16, 2020, in conjunction with Finvek Advisors, S.A. de C.V., we incorporated Programa Lazos, S.A. de C.V. (“Programa Lazos”), focused on granting loans and financial leasing or financial factoring operations in Mexico. We own 70% of the voting shares of Programa Lazos.

vi

Other Transactions during 2021 and Subsequent Events during 2022

On March 12, 2021, Betterware entered into an agreement to acquire 60% of GurúComm, S.A.P.I. de C.V. (“GurúComm”), for Ps.45 million. GurúComm is a mobile virtual network operator and communications software developer, with an enterprise value of Ps.75 million (approximately US$3.5 million). On March 28, 2022, the shareholders of GurúComm approved, and Betterware agreed to, the redemption of the shares owned by Betterware in GurúComm. Therefore, the 55,514 shares that had been previously fully subscribed and paid by Betterware were redeemed. The additional 37,693 shares that were subscribed but not yet paid, were canceled. GurúComm’s redemption and Betterware’s investment withdrawal was mainly due to the fact that the business was not growing according to shareholders expectations, and consequently, Betterware’s investment return would take longer than anticipated. The financial impact that the redemption transaction had at a consolidated level was a loss in sale of shares of Ps.16.6 million.

Until June 30, 2021, BLSM (formerly a related party of Betterware) provided administrative, technical, and operational services to Betterware. On July 1, 2021, all of BLSM’s employees were transferred to Betterware, without having a material impact on a consolidated basis.

On July 22, 2021, Betterware entered into an agreement to acquire 70% of Innova Catálogos, S.A. de C.V. (“Innova”), for Ps.5 million. Innova focuses on purchase and sale of clothing, footwear and accessories. On November 18, 2022, we withdrew our investment and cancelled all of the 238 subscribed and paid shares that we held in Innova. The investment withdrawal and the redemption of Betterware’s shares in Innova was mainly due to the fact that the business was not growing according to shareholders expectations. The financial impact that the redemption transaction had at a consolidated level was a loss in sale of shares of approximately Ps.5 million.

On March 25, 2021, Betterware and Programa Lazos, S.A acquired 2% and 98%, respectively, of the shares of Finayo, S.A.P.I. de C.V., a Mexican sociedad anónima promotora de inversión de capital variable for the aggregate purchase price of Ps.1.1 million. Finayo, S.A.P.I. de C.V. focuses on granting loans, financial leasing and factoring operations.

The JAFRA Acquisition

On January 18, 2022, Betterware entered into a stock purchase agreement to acquire the operations of Jafra Cosmetics International, Inc. and Jafra Mexico Holding Company, B.V. in Mexico and the United States from the Vorwerk Group based in Germany for a total cash consideration of US$255 million (equivalent to Ps. 5,355 million), on a debt and cash-free basis (the “JAFRA Acquisition”). See “Company Information—Organizational Structure.”

JAFRA is a leading global company in direct sales in the beauty and personal care (B&PC) industry with strong presence in Mexico and the United States through independent leaders and consultants who sell JAFRA’s unique products. The JAFRA Acquisition was approved by the Federal Economic Competition Commission on March 24, 2022, and consummated on April 7, 2022. The funds necessary to pay the purchase price, and other associated expenses, under the JAFRA Acquisition were obtained from (i) a long-term syndicated loan of Ps.4,499 million, and (ii) US$30 million from available cash of Betterware. See “Indebtedness—Long Term Syndicated Credit Line.”

As of the date of this annual report and as consequence of the transactions described before, the total number of outstanding shares of the Company is 37,316,546.

PRESENTATION OF INDUSTRY AND MARKET DATA

In this annual report, we rely on, and refer to, information regarding our business and the markets in which we operate and compete. The market data and certain economic and industry data and forecasts used in this annual report were obtained from internal surveys, market research, governmental and other publicly available information, and independent industry publications. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We believe that these industry publications, surveys, and forecasts are reliable, but we have not independently verified them and cannot guarantee their accuracy or completeness.

Certain market share information and other statements presented herein regarding our position relative to our competitors are not based on published statistical data or information obtained from independent third parties, but reflects our best estimates. We have based these estimates upon information obtained from publicly available information from our competitors in the industry in which we operate.

vii

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

| A. | [Reserved] |

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| D. | RISK FACTORS |

An investment in our Ordinary Shares carries a significant degree of risk. You should carefully consider the following risk factors, together with all of the other information included in this annual report, before making a decision to invest in our ordinary shares. The risks described below are those which the Group believes are the material risks that it faces. Some statements in this annual report, including such statements in the following risk factors, constitute forward-looking statements. See the section entitled “Cautionary Note Regarding Forward-Looking Statements.” If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

Risks Related to Our Business

If we are unable to retain our existing, or recruit new, independent distributors, leaders and consultants, our results of operations could be negatively affected.

We distribute almost all of our products through our independent distributors, leaders and consultants, and we depend on them directly for the sale of our products. We experience high turnover among distributors, leaders and consultants from year to year since they can terminate their services at any time. As a result, we need to make significant efforts to retain existing and recruit or attract others.

To increase our revenue, we must increase the number and/or the productivity of our distributors, leaders and consultants. The number and productivity of our distributors, leaders and consultants also depends on several additional factors, including:

| ● | adverse publicity regarding of any company of the Group, our products or our distribution channel; |

| ● | aggressive new competitors in the market looking to increase their market share; |

| ● | failure to motivate our distributors, leaders and consultants with new products; |

| ● | failure to provide an attractive compensation plan for distributors, leaders and consultants; |

1

| ● | issues with our new product’s quality; |

| ● | the public’s perception of our products; |

| ● | competition for distributors, leaders and consultants from other direct selling companies; |

| ● | the public’s perception of our distributors, leaders and consultants, and direct selling businesses in general; and |

| ● | general economic and business conditions. |

Our operations would be harmed if we fail to generate continued interest and enthusiasm among our distributors, leaders and consultants or we fail to attract new, or if our distributors, leaders and consultants are unable to operate due to internal or external factors.

The number of our active distributors, leaders and consultants, may not increase and could decline in the future. Our operating results could be harmed if existing and new business opportunities and products do not generate sufficient interest to retain existing distributors, leaders and consultants recruit new of them.

The loss of key high-level distributors, leaders or consultants could negatively impact our growth and our revenue.

As of December 31, 2022, BWM had approximately 778,845 active associates and 39,413 distributors, and JAFRA had approximately 492,191 and 21,385 active consultants and leaders, respectively. BWM’s distributors and JAFRA’s leaders and consultants, together with their extensive networks of downline distributors or leaders, account for an important part of our net revenue. As a result, the loss of a high-level distributors, leaders or consultants, could negatively impact our network growth and our net revenue.

A decline in our customers’ purchasing power or consumer confidence or in customers’ financial condition and willingness to spend could materially and adversely affect our business.

The sale of our products strongly correlates to the level of consumer spending generally, and thus is significantly affected by the general state of the economy and the ability and willingness of consumers to spend on discretionary items. Reduced consumer confidence and spending generally may result in reduced demand for our products and limitations on our ability to maintain or increase prices. A decline in economic conditions or general consumer spending in any of our major markets could have a material adverse effect on our business, financial condition and results of operations.

Failure to successfully develop new products could harm our business.

An important component of our business is our ability to develop new products that create enthusiasm among our customers. If we fail to introduce new products planned for the future, our distributors, leaders and consultants’ productivity could be harmed. In addition, if our new products fail to gain market acceptance, are restricted by regulatory requirements, or have quality problems, this would harm our results of operations. Factors that could affect our ability to continue to introduce new products include, among others, government regulations, proprietary protections of competitors that may limit our ability to offer comparable products and any failure to anticipate changes in consumer tastes and buying preferences.

We depend on multiple contract manufacturers mostly located in China, and the loss of the services provided by any of our manufacturers could harm our business and results of operations.

We outsource product manufacturing to third-party contractors located mainly in China. During the 2022 period, products supplied by Chinese manufacturers accounted for approximately 93% of BWM’s revenues.

If these suppliers have unscheduled downtime or are unable to fulfill their obligations under these manufacturing agreements because of political or regulatory restrictions, equipment breakdowns, labor strikes, natural disasters, health diseases or health epidemics, such as the COVID-19 pandemic, or any other cause, this could adversely affect our overall operations and financial condition.

Also, although we provide all of the formulations used to manufacture our products, we have limited control over the manufacturing process itself. As a result, any difficulties encountered by the third-party manufacturer that result in product defects, production delays, cost overruns, or the inability to fulfill orders on a timely basis, due to, for instance, sanctions or blocks imposed to Chinese products, could have a material adverse effect on our business, financial condition and operating results

2

Disruptions or delays at our facility in Queretaro, Mexico could have a material adverse effect on our business, particularly with respect to the beauty and personal care segment.

Our facility in Queretaro, Mexico, manufactures a substantial portion of the products of our beauty and personal care segment, which accounts 85% of JAFRA sales, and as of December 31, 2022 represented 38% of our total sales at a consolidated level. Significant unscheduled downtime or a reduction in capacity at this facility, whether due to equipment breakdowns, power failures, natural disasters (due to climate change or otherwise), pandemics (including COVID-19), weather conditions hampering delivery schedules, shortages of raw materials and products, technology disruptions or other disruptions, including those caused by transitioning manufacturing across these facilities, or any other cause could have a material adverse effect on our ability to provide products to our leaders, consultants and customers, which could have a material adverse effect on our sales, business, prospects, reputation, results of operations, financial condition and/or cash flows.

Additionally, some of our employees at this facility are members of labor unions. In the past, we have experienced labor-union related work strikes in Mexico which have affected our operations. Also, negotiating labor contracts, either for new locations or to replace expiring contracts, is time consuming or may not be accomplished on a timely basis. If we are unable to satisfactorily negotiate those labor contracts with the labor unions on terms acceptable to us or without a strike or work stoppage, the effects on our business could be materially adverse. Any strike or work stoppage could disrupt our business, adversely affecting our results of operations and our public image could be materially adversely affected by such labor disputes. In addition, existing labor contracts may not prevent a strike or work stoppage, and any such work stoppage could have a material adverse effect on our business.

Volatility in costs, along with delays and disruptions in the supply of materials and services, as a result of the recent global supply chain disruptions, could have a material adverse effect on our business, prospects, results of operations, financial condition and/or cash flows.

We purchase raw materials, including essential oils, alcohols, chemicals, containers and packaging components, from various third-party suppliers. Substantial cost increases delays and the unavailability of raw materials or other commodities, as a result of continued global supply chain disruptions, and higher costs for energy, transportation and other necessary services have adversely affected and may continue to adversely affect our beauty and personal care segment profit margins if we are unable to wholly or partially offset them, such as by achieving cost efficiencies in its supply chain, manufacturing and/or distribution activities. In addition, we purchase certain finished goods, raw materials, packaging and other components from single-source suppliers or a limited number of suppliers and if we are required to find alternative sources of supply, these new suppliers may have to be qualified under applicable industry, governmental and Company-mandated vendor standards, which can require additional investment and be time-consuming.

Any significant disruption to our manufacturing or sourcing of products or raw materials, packaging and other components for any reason (including the continued global supply chain disruptions) could materially impact our inventory levels and interrupt and delay our supply of products to its leaders and consultants. Such events, if not promptly remedied, could have a material adverse effect on our business, prospects, reputation, results of operation, financial condition and/or cash flows.

Competition could have a material adverse effect on our business, prospects, results of operations, financial condition and/or cash flows.

The markets in which we operate are competitive. Our results of operations may be harmed by market conditions and competition in the future. Many competitors have greater name recognition and financial resources than we have, which may give them a competitive advantage.

We compete against a number of multi-national manufacturers, some of which are larger and have substantially greater resources than us, and which may therefore have the ability to spend more aggressively than us on new business acquisitions, research and development activities, technological advances to evolve in their e-commerce capabilities and advertising, promotional, social media and/or marketing activities and have more flexibility than us to respond to changing business and economic conditions.

Also, our products compete directly with branded, premium retail products. We currently do not have significant patent or other proprietary protection, and competitors may introduce products with the same ingredients that we use in our products.

We also compete with other companies for distributors, leaders and consultants. Some of these competitors have a longer operating history, better name recognition and greater financial resources than we do. Some of our competitors have also adopted and could continue to adopt some of our business strategies. Consequently, to successfully compete in this market and attract and retain distributors, leaders and consultants, we must ensure that our business opportunities and compensation plans are financially rewarding. We may not be able to continue to successfully compete in this market for distributors, leaders and consultants, which would ultimately, affect our business operations.

3

If the industry in which we operate, our business or our products are subject to adverse publicity, our business may suffer.

We are very dependent upon our distributors, leaders, consultants and the general public perception of the overall integrity of our business, as well as the safety and quality of our products and similar products distributed by other companies. The number and motivation of our distributors, leaders and consultants and the acceptance by the general public of our products may be negatively affected by adverse publicity regarding:

| ● | the legality of network-marketing systems in general or our network-marketing system specifically; |

| ● | the safety and quality of our products; |

| ● | regulatory investigations of our products; |

| ● | the actions of our distributors, leaders and consultants; |

| ● | management of our distributors, leaders and distributors; and |

| ● | the direct selling industry. |

Any event that negatively affects the general public perception of our industry, business or products could have a material effect in our results of operations.

Failure of our technology initiatives to create sustained enthusiasm in our distributors, leaders and consultants and incremental cost savings could negatively impact our business.

We constantly develop and implement strategies to continue using technology to attract distributors, leaders and consultants and provide them new technology to facilitate taking orders of our products. In certain demographic markets, we have experienced some success implementing our technology strategies to improve our operating efficiency. However, any cost savings from our technology strategies may not prove to be significant, or we may not be successful in adapting and implementing these strategies to other markets in which we operate. This could result in our inability to service our distributors, leaders and consultants in the manner they expect, which could ultimately affect our results of operations.

We are dependent on information and communication technologies, and our systems and infrastructures face certain risks, including cybersecurity risks.

The operation of complex infrastructures and the coordination of the many actors involved in our operation require the use of several highly specialized information systems, including both our own information technology systems and those of third-party service providers, such as systems that monitor our operations or the status of our facilities, communication systems to inform the public, access control systems and closed circuit television security systems, infrastructure monitoring systems and radio and voice communication systems used by our personnel. In addition, our accounting and fixed assets, payroll, budgeting, human resources, supplier and commercial, hiring, payments and billing systems and our websites are key to our functioning. The proper functioning of these systems is critical to our operations and business management. These systems may, from time to time, require modifications or improvements as a result of changes in technology, the growth of our business and the functioning of each of these systems.

The risk of cyber-crime continues to augment across all industries and geographies as infiltrating technology is becoming increasingly sophisticated. If we are unable to prevent a significant cyber-attack, such attack could materially disrupt our operations, damage our reputation and lead to regulatory penalties and financial losses. To prevent such disruptions to our operations we have implemented a multi-layer security framework, from strategic corporate policies to operational procedures and controls. To support this framework, we use sophisticated technologies to secure our perimeter, computing equipment, networks, servers, storage and databases.

Information technology systems cannot be completely protected against certain events such as natural disasters, fraud, computer viruses, hacking, communication failures, equipment breakdown, software errors and other technical problems. However, our security framework allows us to minimize and manage these risks through the use of enabling technologies such as, but not limited to, firewalls, mail & web filtering, end point protection, antivirus and anti malware, access lists, encryption and hardening.

4

In addition, our business operations routine involves gathering personal information about vendors, distributors, leaders, consultants, customers and employees among others, through the use of information technologies. Breaches of our systems or those of our third-party contractors, or other failures to protect such information, could expose such people’s personal information to unauthorized use. Any such event could give rise to a significant potential liability and reputational harm.

During 2022 and 2021, BWM encountered an increased number of non-material phishing attempts which consisted of fake e-mails requesting minor payments and/or confidential information and e-mails with malicious files successfully quarantined and contained as well as sporadic attempted attacks, minor and unsuccessful, on our infrastructure. None of these attempts were material nor had any major consequences for our operations or our customers. However, we cannot guarantee any future events will not affect our operations or customers. We are constantly seeking to improve and strengthen our security strategy by aligning it with Security Frameworks and Best Practices such as NIST and ISO 27000.

During 2021 (prior to consummation of the JAFRA Acquisition), JAFRA received various attacks with at least one impacting IT servers such as email, SharePoint, and other Information Technology support services. None of these attacks affected our core servers or our customers’ personal information. In 2022, JAFRA implemented a Security Operation Center for purposes of identifying and preventing cybersecurity attacks. This Security Operation Center has prevented a considerable number of incidents such as: ransomware attacks (nine in total), malware execution via USB, malicious URLs, malicious content from email, various JAFRA account login attempts and phishing. No attacks were materialized during the 2022 period. We expect align JAFRA’s operations with the NIST CSF and ISO 27000 frameworks.

Because of the costs and difficulties inherent in managing cross-border business operations, our results of operations may be negatively impacted.

Managing our business, operations, personnel or assets in multiple jurisdictions is challenging and costly. Management may be inexperienced in cross-border business practices and unaware of significant differences in accounting rules, legal regimes and labor practices. Even with a seasoned and experienced management team, the costs and difficulties inherent in managing cross-border business operations, personnel and assets can be significant (and much higher than in a purely domestic business) and may negatively impact our financial and operational performance.

Our distributors, leaders and consultants are independent contractors and not employees. If regulatory authorities were to determine, however, that our distributors leaders and consultants are legally our employees, we could have significant liability under social benefit laws.

Distributors, leaders and consultants are self-employed and are not our employees. Periodically, the question of the legal status of our distributors, leaders and consultants has arisen, usually with regard to possible coverage under social benefit laws that would require us to make regular contributions to social benefit funds. We cannot guarantee there will not be a future judicial or administrative determination adverse to the current criteria, which would substantial and materially adversely affect our business and financial condition.

Inflation could adversely affect our business and results of operations.

While inflation in the United States and global markets has been relatively low in recent years, during 2021 and 2022, the economy in the United States and global markets encountered a material increase in the level of inflation. The impact of COVID-19, geopolitical developments such as the Russia-Ukraine conflict and global supply chain disruptions continue to increase uncertainty in the outlook of near-term and long-term economic activity, including whether inflation will continue and how long, and at what rate. Increases in inflation raise our costs for commodities, labor, materials and services and other costs required to grow and operate our business, and failure to secure these on reasonable terms may adversely impact our financial condition. Additionally, increases in inflation has caused, and may in the future cause, global economic uncertainty and uncertainty about the interest rate environment, which may make it more difficult, costly or dilutive for us to secure additional financing. A failure to adequately respond to these risks could have a material adverse impact on our financial condition, results of operations or cash flows.

5

Goodwill, property, plant and equipment and intangible assets represent a significant portion of the Group’s statement of financial position, and our operating results may suffer from possible impairments.

Goodwill, property, plant and equipment and intangible assets in our statement of financial position derived from past business combinations carried out by the Group, are further explained in the notes to the consolidated financial statements located elsewhere in this annual report. Goodwill and intangible assets with indefinite useful lives are tested for impairment at least annually. Property, plant and equipment and intangible assets with definite useful lives are tested for impairment whenever there is an indication that these assets may be impaired. In the case of an impairment, we will recognize charges to our operating results based on the impairment assessment processes. In addition, future acquisitions may be made by the Group and a portion of the purchase price of these acquisitions may be allocated to acquired goodwill, property, plant and equipment and intangible assets. An impairment on property, plant and equipment or goodwill of acquired businesses could have a material adverse effect on our financial condition and results of operations.

The COVID-19 virus (nCoV), as well as any other public health crises that may arise in the future, has had and may continue to have a negative impact on our gross margins and in our results of operation.

In late December 2019, a notice of pneumonia of unknown cause originating from Wuhan, Hubei province of China was reported to the World Health Organization. A novel COVID-19 virus (nCoV) was identified, with cases soon confirmed in multiple provinces in China, as well as in several other countries. The Chinese government placed Wuhan and multiple other cities in Hubei province under quarantine, with approximately 60 million people affected. On March 11, 2020, the World Health Organization declared the coronavirus outbreak a pandemic. The COVID-19 pandemic has resulted in several cities be placed under quarantine, increased travel restrictions from and to several countries, such as the U.S., China, Italy, Spain and Mexico which had forced extended shutdowns of certain businesses in certain regions.

Our operations were not interrupted as a result of the COVID-19 pandemic in 2021 and 2020. However, during 2022, after the COVID-19 pandemic effects eased, we suffered a decline in the number of associates and distributors due to the contraction of the market size for home goods and in consumer spending. Consequently, our net revenue related to our home organization segment decreased by 37.0%.

Also, as consequence of the COVID-19 pandemic, we faced external headwind as supply chain disruption in China, specifically increases in sea freight prices and the rationing of energy, has caused partial and total shutdowns of some factories. If these events continue, our results of operations could be negatively impacted. We cannot predict future events that could disrupt our supply chain.

Although impact of COVID-19 pandemic has eased as restrictions have been or are being lifted in most of the countries we operate, the continuing impact of COVID-19 pandemic remains uncertain and may continue to affect our operations and the markets in which we operate, for so long as the health crisis and the virus impact continues, including the emergence of new strains such as the Omicron or Delta variant, of the virus arise.

Material weaknesses have been identified in Betterware’s internal control over financial reporting, and if we fail to establish and maintain proper and effective internal controls over financial reporting, our results of operations and our ability to operate our business may be harmed.

As of December 31, 2022, our management assessed the effectiveness of our internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control - Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission in 2013.

Our results conclude thar we did not design and maintain effective controls over the (i) business combination transaction process; (ii) period-end financial reporting and consolidation process; and (iii) certain information technology (“IT”) general controls for information systems that are relevant to the preparation of our consolidated financial statements.

We are in the process of implementing several measures to strength our internal control over financial reporting such as the deployment of IT applications to enable and automate the consolidation and ITGC process. For details of the controls and remediation plan, see “Item 15—Controls and Procedures—Disclosure Controls and Procedures.”

6

In 2021, the Company changed its status from an emerging growth company to an large accelerated filer, and during 2022 the Company change its status again to an accelerated filer. Therefore, the Company keep working and improving about the implementation of a formal internal control over financial reporting program based on a top-down risk assessment to validate the existence of controls over significant, accounts, processes, applications and IT environments. See “Disclosure Controls and Procedures—Control and Procedures.”

If we fail to establish and maintain proper and effective internal controls over financial reporting or adequately resolve our existing material weaknesses, our results of operations and our ability to operate our business may be harmed.

Our controlling shareholder may have interests that conflict with your interests.

As of the date of this annual report, Campalier owns approximately 53.65% of our outstanding Ordinary Shares. As the controlling shareholder, Campalier may take actions that are not in the best interests of the Group’s other shareholders. These actions may be taken in many cases even if they are opposed by the Group’s other shareholders. In addition, this concentration of ownership may discourage, delay or prevent a change in control which could deprive you of an opportunity to receive a premium for your Ordinary Shares as part of a sale of the Group.

Our business and results of operations may be adversely affected by the increased strain on our resources from complying with the reporting, disclosure and other requirements applicable to public companies in the United States promulgated by the U.S. Government, Nasdaq or other relevant regulatory authorities.

Compliance with existing, new and changing corporate governance and public disclosure requirements adds uncertainty to our compliance policies and increases our costs of compliance. Changing laws, regulations and standards include those relating to accounting, corporate governance and public disclosure, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Sarbanes-Oxley Act of 2002, new SEC regulations and the Nasdaq listing guidelines. Application of these laws, regulations and guidelines may evolve over time as new guidance is provided by regulatory and governing bodies. In particular, compliance with Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”) and related regulations regarding required assessment of internal controls over financial reporting and our external auditor’s audit of that assessment, requires the commitment of significant financial and managerial resources. We also expect the regulations to increase our legal and financial compliance costs, making it more difficult to attract and retain qualified officers and members of our board of directors, particularly to serve on our audit committee, and make some activities more difficult, time-consuming and costly.

Existing, new and changing corporate governance and public disclosure requirements could result in continuing uncertainty regarding compliance matters and higher costs of compliance as a result of ongoing revisions to such governance standards. Our efforts to comply with evolving laws, regulations and standards have resulted in, and are likely to continue to result in, increased general and administrative expenses. In addition, new laws, regulations and standards regarding corporate governance may make it more difficult for our company to obtain director and officer liability insurance. Further, our board members and senior management could face an increased risk of personal liability in connection with their performance of duties. As a result, we may face difficulties attracting and retaining qualified board members and senior management, which could harm our business. If we fail to comply with new or changed laws or regulations and standards differ, our business and reputation may be harmed.

Our revenue and profitability may be affected if we fail to acquire new companies or integrate those that we have already acquired, such as JAFRA.

We consider acquisitions a useful instrument to complement our organic growth. We opportunistically explore acquiring other businesses and assets, such as the JAFRA Acquisition.

However, we may face financial, managerial and operational challenges, including diversion of management attention and resources needed for existing operations, difficulties with integrating acquired businesses, such as JAFRA, integration of different corporate cultures, increased expenses, potential dilution of our brand, assumption of unknown liabilities, potential disputes with the sellers and the need to evaluate the financial systems of and establish internal controls for acquired entities. Further, we seek out acquisitions of companies that maintain the same high quality standards that we maintain, and if we misjudge or overestimate products quality standards, we may not be able to use these products or implement the strategies that were the primary reason for the corresponding acquisition, such as may be the case with the JAFRA Acquisition, which would lead to a significant loss both financially and in time spent by our teams trying to integrate the products or implement the strategy.

7

In addition, our ability to realize the benefits we anticipate from our acquisition activities, including the JAFRA Acquisition, including any anticipated sales growth, cost synergies and other anticipated benefits, will depend in large part upon whether we are able to integrate such businesses efficiently and effectively. Integration is an ongoing process, and we may not be able to fully integrate such businesses smoothly or successfully, and the process may take longer than expected. Further, the integration of certain operations and the differences in operational culture following such activity will continue to require the dedication of significant management resources, which may distract management’s attention from day-to-day business operations.

There may also be unasserted claims or assessments that we failed or were unable to discover or identify in the course of performing due diligence investigations of target businesses. While we normally negotiate representation and warranties and related indemnification in relation to such acquisitions, these may not be enough to cover our exposure if a significant liability arises in connection with any acquisition agreement, including the JAFRA Acquisition. We cannot assure you that these indemnification provisions will protect us fully or at all, and as a result we may face unexpected liabilities that could adversely affect our business, financial condition and results of operations.

If we are unable to successfully integrate the operations of JAFRA, or any other acquired business, into our business, we may be unable to realize the sales growth, cost synergies and other anticipated benefits of such transactions, and our business, results of operations and cash flow could be adversely affected.

Our indebtedness and any future inability to meet any of our obligations under our indebtedness, could adversely affect us by reducing our flexibility to respond to changing business and economic conditions.

As of December 31, 2022, we had Ps.6,441 million of outstanding indebtedness (current and non-current borrowings, and leases). We rely on obtaining financing and refinancing of existing indebtedness in order to operate our business, implement our strategy and grow our business. Recent disruptions in the global credit markets and their effect on the global and Mexican economies could materially adversely affect our business. We may also incur additional working capital lines of credit to meet future financing needs, subject to certain restrictions under our indebtedness, which would increase our total indebtedness. We may be unable to generate sufficient cash flow from operations and future borrowings, and other financing may be unavailable in an amount sufficient to enable us to fund our current and future financial obligations or our other liquidity needs, which would have a material adverse effect on our business, prospects, financial condition, liquidity and results of operations as well as reduce the availability of our cash flow to fund working capital, operations, capital expenditures, dividend payments, strategic acquisitions, expansion of our operations and other business activities. Our indebtedness could have material negative consequences on our business, prospects, financial condition, liquidity, results of operations and cash flows, including the following:

| ● | limitations on our ability to obtain additional debt financing sufficient to fund growth, such as working capital and capital expenditures requirements or to meet other cash requirements, in particular during periods in which credit markets are weak; |

| ● | a downgrade in our credit ratings; |

| ● | a limitation on our flexibility to plan for, or react to, competitive challenges in our business and industry; |

| ● | the possibility that we are put at a competitive disadvantage relative to competitors with less debt or debt with more favorable terms than us, and competitors that may be in a more favorable position to access additional capital resources and withstand economic downturns; |

| ● | limitations on our ability to execute business development activities to support our strategies or ability to execute restructuring as necessary; and |

| ● | limitations on our ability to invest in recruiting, retaining and servicing our distributors, leaders and consultants. |

Certain of our indebtedness contain customary covenants, including, among other things, limits on the ability of the company and any restricted subsidiary to, subject to certain exceptions, incur liens, incur debt, merge, consolidate or dispose of all or substantially all of its assets.

8

Changes in taxes and other assessments may adversely affect us.

The legislatures and tax authorities in the tax jurisdictions in which we are subject to tax regularly enact reforms to the tax and other assessment regimes to which we, our distributors, leaders and consultants, and our customers are subject. Such reforms include changes in tax rates and, occasionally, enactment of temporary taxes, the proceeds of which are earmarked for designated governmental purposes. In addition, the interpretation of tax laws by courts and taxation authorities is constantly evolving. The effects of these changes and any other changes that result from enactment of additional tax reforms or changes to the manner in which current tax laws are applied cannot be quantified and there can be no assurance that any such reforms or changes would not have an adverse effect upon our business directly or indirectly (e.g., by affecting the business of our consultants and representatives).

For example, Latin American governments have often increased taxes or changed tax legislation as a response to macroeconomic crises or other developments affecting their respective jurisdictions. These and any other possible future changes in tax policy laws in the countries where we are subject to tax may adversely affect our business, financial condition and results of operations.

We are subject to environmental laws and regulations risks that could affect our operations and results of operations

Our operations are subject to a wide range of environmental laws and regulations in each of the jurisdictions in which we operate. These laws and regulations impose increasingly rigorous environmental protection standards. According to Mexican General Law of Ecological Balance and Environmental Protection (Ley General de Equilibrio Ecológico y la Protección al Ambiente or LGEEPA in Spanish), organizations must comply with the following, among others: (i) guarantee the human right of every person to a healthy environment for their development and well-being; (ii) the preservation, restoration and improvement of the environment; (iii) the preservation and protection of biodiversity, as well as the establishment and administration of protected natural areas; (iv) the sustainable use, preservation and, where appropriate, restoration of soil, water and other natural resources, so that they are compatible for obtaining economic benefits and the activities of society with the preservation of the ecosystems; and (v) prevention and control of air, water and soil pollution, among others. The establishment of these controls and security measures exposes us to a risk of significant environmental costs and responsibilities, such as taxes, investment in equipment and technology, investment in spaces for development and well-being, fines and penalties. In addition, we are exposed to the fact that, over time, these laws and regulations may become more stringent over existing ones, which could lead to the imposition of new risks and costs resulting in a decrease in our profitability.

Environmental requirements can restrict trade which could lead to increased transportation and import costs for the products we sell to our customers.

Environmental, social and corporate governance (ESG) issues, including those related to climate change and sustainability, may have an adverse effect on our business, financial condition and results of operations and damage our reputation.

There is an increasing focus from certain investors, customers, consumers, employees and other stakeholders concerning ESG matters. Additionally, public interest and legislative pressure related to public companies’ ESG practices continue to grow. If our ESG practices fail to meet regulatory requirements or investor, customer, consumer, employee or other stakeholders’ evolving expectations and standards for responsible corporate citizenship in areas including environmental stewardship, support for local communities, board of director and employee diversity, human capital management, employee health and safety practices, product quality, supply chain management, corporate governance and transparency, our reputation, brand and employee retention may be negatively impacted, and our customers and suppliers may be unwilling to continue to do business with us. See “Company Information—Environment, Social and Governance.”

Customers, consumers, investors and other stakeholders are increasingly focusing on environmental issues, including climate change, energy and water use, plastic waste and other sustainability concerns. Concern over climate change may result in new or increased legal and regulatory requirements to reduce or mitigate impacts to the environment. Changing customer and consumer preferences or increased regulatory requirements may result in increased demands or requirements regarding plastics and packaging materials, including single-use and non-recyclable plastic products and packaging, other components of our products and their environmental impact on sustainability, or increased customer and consumer concerns or perceptions (whether accurate or inaccurate) regarding the effects of substances present in certain of our products. Complying with these demands or requirements could cause us to incur additional manufacturing, operating or product development costs.

If we do not adapt to or comply with new regulations, or fail to meet evolving investor, industry or stakeholder expectations and concerns regarding ESG issues, investors may reconsider their capital investment in our Company, and customers and consumers may choose to stop purchasing our products, which could have a material adverse effect on our reputation, business or financial condition.

9

Our products are subject to federal, state and international regulations that could have a material adverse effect on our business, prospects, results of operations, financial condition and/or cash flows.

Our business is subject to numerous laws, regulations and trade policies. We are subject to regulation by the FTC and the FDA in the U.S., as well as various other federal, state, local and foreign regulatory authorities, including those in the countries in which the Company operates. Our facility located in Queretaro, Mexico is registered with the FDA as a drug manufacturing establishment, permitting the manufacture of cosmetics and other beauty-care products that contain over-the-counter drug ingredients, such as sunscreens, anti-perspirant deodorants and anti-dandruff hair-care products. Regulations in the U.S., the EU, Canada and other countries in which we operate are designed to protect consumers or the environment, such as regulations enacted to address the impacts of climate change, have an increasing influence on our product claims, ingredients and packaging. To the extent federal, state, local and/or foreign regulatory changes occur in the future, whether due to changes in applicable laws or regulations or evolving interpretations and enforcement policies by regulatory authorities, they could require us to reformulate or discontinue certain of our products or revise its product packaging or labeling, any of which could result in, among other things, increased our costs, delays in product launches, product returns or recalls and lower net sales, and therefore could have a material adverse effect on our business, prospects, results of operations, financial condition and/or cash flows

Risks Related to Mexico

Since more that 90% our operations are concentrated in Mexico, economic developments in Mexico may adversely affect our business and results of operations.

Currently, almost all of our operations are conducted, and almost all of our customers are located, in Mexico. Accordingly, our ability to raise revenues, our financial condition and results of operations are substantially dependent on the economic conditions prevailing in Mexico. As a result, our business may be significantly affected by the Mexican economy’s general condition, by the depreciation of the Mexican peso, by inflation and high interest rates in Mexico, or by political developments in Mexico. Declines in growth, high rates of inflation and high interest rates in Mexico have a generally adverse effect on our operations. If inflation in Mexico increases while economic growth slows, our business, results of operations and financial condition will be affected. In addition, high interest rates and economic instability could increase our costs of financing. For the years ended December 31, 2021, and 2022, GDP increased 4.8% and decreased to 3.1%, respectively.

During 2022, Mexico’s sovereign debt rating has been confirmed and a stable outlook has been maintained. We cannot ensure that the rating agencies will not announce an outlook revision and/or any downgrades of Mexico or any of its state owned companies. These revisions and downgrades could adversely affect the Mexican economy and, consequently, our business, financial condition, operating results and prospects.

In the event that the Mexican economy continues to experience a deterioration of economic conditions such as rising inflation, additional interest rate increases, downgrade of sovereign debt, among other factors, the activities, financial situation, operating results, cash flows and/or prospects of the Group, could be adversely and significantly affected.

Developments in other countries could materially affect the Mexican economy and, in turn, our business, financial condition and results of operations.

Mexico’s economy is vulnerable to global market downturns and economic slowdowns. The global economy, including Mexico’s economy, has been materially and adversely affected by a significant lack of liquidity, disruption in the credit markets, reduced business activity, rising unemployment, interest rates changes and erosion of consumer confidence during the global pandemic and its effects. This situation has had a direct adverse effect on the purchasing power of our customers in Mexico. The macroeconomic environment in which we operate is beyond our control, and the future economic environment may continue to be less favorable than in recent years. There is no assurance of a strong economic recovery or that the current economic conditions will ameliorate. The risks associated with current and potential changes in the Mexican economy are significant and could have a material adverse effect on our business and results of operations.

The market prices of securities issued by companies with Mexican operations are affected to varying degrees by the economic and market situation in other places, including the United States, China, the rest of Latin America and other countries with emerging markets. Therefore, investors’ reactions to events in any of these countries could have an adverse effect on the market price of securities issued by companies with Mexican operations. Past economic crises that have occurred in the United States, China or in countries with emerging markets could cause a decrease in the levels of interest in the securities issued by companies with Mexican operations.

In the past, the emergence of adverse economic conditions in other emerging countries has led to capital flight and, consequently, to decreases in the value of foreign investments in Mexico. The financial crisis that arose in the United States during the third quarter of 2008, unleashed a global recession that directly and indirectly affected the economy and the Mexican stock markets and caused, among other things, fluctuations in purchase prices the sale of securities issued by publicly traded companies, shortage of credit, budget cuts, economic slowdowns, volatility in exchange rates, and inflationary pressures.