As part of the Combination and Stock Purchase Agreement, and prior to the closing of the Merger, DD3 was redomiciled out of the British Virgin Islands and continued as a Mexican corporation pursuant to Section 184 of the Companies Act and Article 2 of the Mexican General Corporations Law.

The Company Restructure

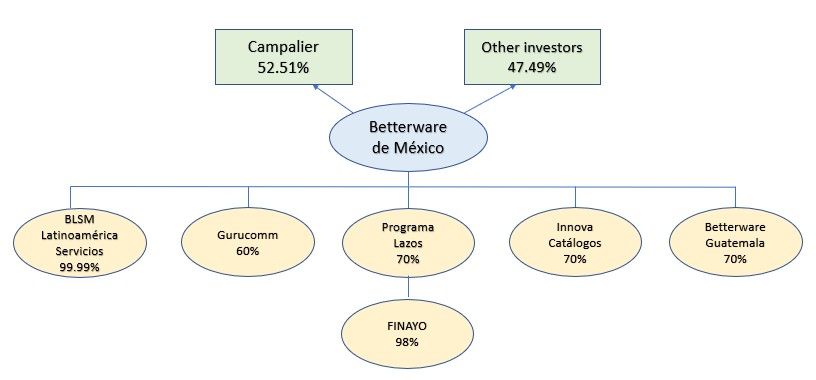

Following the execution of the Combination and Stock Purchase Agreement, on February 21, 2020, the Company’s shareholders approved, a corporate restructure in the Company (the “Company Restructure”) which implied, among other things (i) the Company’s by-laws amendment in order to issue Series C and Series D non-voting shares, and (ii) a redistribution of the Company’s capital stock as follows: (a) fixed portion of the Company’s capital stock represented by 3,075,946, Series A, ordinary voting shares, and (b) the variable portion of the Company’s capital stock represented by (x) 1,961,993, Series B, ordinary voting shares, (y) 897,261, Series C, ordinary non-voting shares (“Series C Shares”), and (z) 168,734, Series D, ordinary non-voting shares (“Series D Shares”). In addition, Strevo transferred one, Series A, ordinary voting share of Betterware to Campalier (the “Campalier Share”), which remained under certain Share Pledge Agreement, dated July 28, 2017, entered between Strevo, as pledgor, MCRF P, S.A. de C.V. SOFOM, E.N.R. (“CS”), as pledgee, and Betterware.

Immediately after the Company’s Restructure and the transfer of the Campalier Share to Campalier, Forteza indirectly owned, through Banco Invex, S.A., Invex Grupo Financiero (“Invex”), as trustee of the irrevocable management and security trust No. 2397 (the “Invex Security Trust”), executed on March 26, 2016, as amended, with CS, as beneficiary, approximately 38.94% of the outstanding common stock of Betterware, and Campalier indirectly owned, through the Invex Security Trust, approximately 61.06% of the outstanding common stock of Betterware.

On March 9, 2020, the Invex Security Trust released the Series C Shares and the Series D Shares to Campalier and Forteza, respectively, that were held under the Invex Security Trust.

On March 10, 2020, CS, as pledgee, entered into a Termination of the Share Pledge Agreement over the Campalier Share with Campalier, as pledgor, and Betterware. In addition, CS, as beneficiary, Invex, as trustee, and Campalier, as settlor, entered into a Transfer Agreement, where Campalier transferred the Campalier Share to the Invex Security Trust.

Upon such transfer to the Invex Security Trust, the Company’s shareholders approved (i) the sale of all or a portion of such Company’s Series C and Series D shares to DD3 Acquisition Corp., S.A. de C.V. (the “DD3 Acquisition”), (ii) the Merger, (iii) the amendment of the Company’s by-laws to become a sociedad anónima promotora de inversion de capital variable, (iv) the increase of the Company’s capital stock by MX$94,311,438.00, through the issuance of 2,211,075 ordinary shares, without nominal value, subscribed by the shareholders of DD3 Acquisition Corp., S.A. de C.V., and (v) the increase of the Company’s capital stock by MX$872,878,500.00 through the issuance of 4,500,000 ordinary treasury shares without nominal value, offered for subscription and payment under the Company’s public offering in the U.S. completed and filed with the SEC under our Registration Statement on Form F-1, which became effective on January 22, 2020.

On March 10, 2020, Betterware’s corporate name changed from Betterware de México, S.A. de C.V. to Betterware de México, S.A.P.I. de C.V.

The DD3 Acquisition was closed on March 13, 2020, and as a result, all of Betterware shares that were issued and outstanding immediately prior to the closing date were canceled and new shares were issued. The DD3 Acquisition was accounted as a capital reorganization, whereby Betterware issued shares to the DD3 shareholders and obtained US$22,767 (Ps.498,445) in cash through the acquisition of DD3 and, simultaneously settled liabilities and related transaction costs on that date, for net cash earnings of US$7,519 (Ps.181,734) on such date. In addition, Betterware assumed the obligation of the warrants issued by DD3, a liability inherent to the transaction, equivalent to the fair value of Ps.55,810 of the warrants. No other assets or liabilities were transferred as part of the transaction that required adjustment to fair value as a result of the acquisition.

On the same date, a total of 2,040,000 of Betterware shares, that were offered for subscription and payment under its public offering on Nasdaq Capital Market (“Nasdaq”), were subscribed and paid for by various investors.